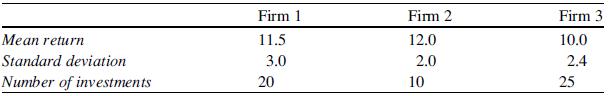

The yearly portfolio returns for 3 different investment firms over a 10-year period are listed in the

Question:

The yearly portfolio returns for 3 different investment firms over a 10-year period are listed in the accompanying table. Do these data show a statistically significant difference in the firms’ performances? Assume that the population errors meet the conditions necessary for ANOVA. Let a = .01.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Statistics For Business And Financial Economics

ISBN: 9781461458975

3rd Edition

Authors: Cheng Few Lee , John C Lee , Alice C Lee

Question Posted: