Question: 5.10. Using a spreadsheet, compute the minimum variance and tangency portfolios for the universe of three stocks described below. Assume the risk-free return is 5

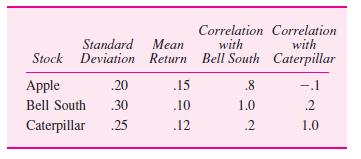

5.10. Using a spreadsheet, compute the minimum variance and tangency portfolios for the universe of three stocks described below. Assume the risk-free return is 5 percent. Hypothetical data necessary for this calculation are provided in the table below. See exercise 5.6 for detailed instructions.

Standard Mean Stock Deviation Return Correlation Correlation with with Bell South Caterpillar Apple .20 .15 .8 -.1 Bell South .30 .10 1.0 Caterpillar .25 .12 22 .2 .2 10 1.0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts