Diaz Company issued $180,000 face value of bonds on January 1, Year 1. The bonds had a

Question:

Diaz Company issued $180,000 face value of bonds on January 1, Year 1. The bonds had a 7 percent stated rate of interest and a five-year term. Interest is paid in cash annually, beginning December 31, Year 1. The bonds were issued at 98. The straight-line method is used for amortization.

Required

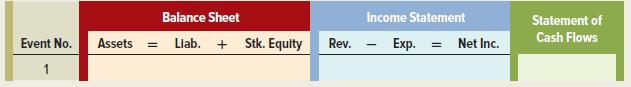

a. Use a financial statements model like the following one to demonstrate how (1) the January 1, Year 1, bond issue and (2) the December 31, Year 1, recognition of interest expense, including the amortization of the discount and the cash payment, affect the company’s financial statements. Use + for increase, − for decrease, and NA for not affected.

b. Determine the carrying value (face value less discount or plus premium) of the bond liability as of December 31, Year 1.

c. Determine the amount of interest expense reported on the Year 1 income statement.

d. Determine the carrying value (face value less discount or plus premium) of the bond liability as of December 31, Year 2.

e. Determine the amount of interest expense reported on the Year 2 income statement.

Step by Step Answer:

Survey Of Accounting

ISBN: 9781260575293

6th Edition

Authors: Thomas Edmonds, Christopher Edmonds, Philip Olds