On January 1, Year 1, Parker Company issued bonds with a face value of $80,000, a stated

Question:

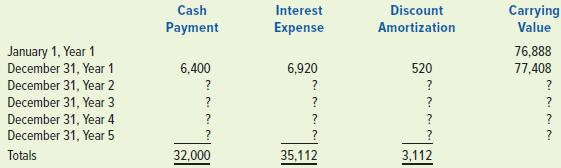

On January 1, Year 1, Parker Company issued bonds with a face value of $80,000, a stated rate of interest of 8 percent, and a five-year term to maturity. Interest is payable in cash on December 31 of each year. The effective rate of interest was 9 percent at the time the bonds were issued. The bonds sold for $76,888. Parker used the effective interest rate method to amortize the bond discount.

Required

a. Prepare an amortization table like the one that follows. Round answers to nearest whole dollar.

b. What item(s) in the table would appear on the Year 4 balance sheet?

c. What item(s) in the table would appear on the Year 4 income statement?

d. What item(s) in the table would appear on the Year 4 statement of cash flows?

Step by Step Answer:

Survey Of Accounting

ISBN: 9781260575293

6th Edition

Authors: Thomas Edmonds, Christopher Edmonds, Philip Olds