In divisional income statements prepared for Anchor Cement Company, the Payroll Department costs are charged back to

Question:

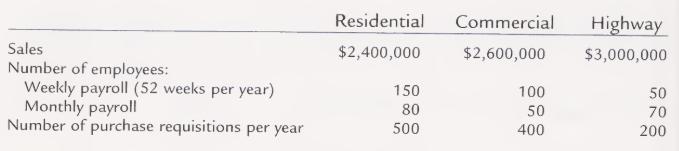

In divisional income statements prepared for Anchor Cement Company, the Payroll Department costs are charged back to user divisions on the basis of the number of payroll checks, and the Purchasing Department costs are charged back on the basis of the number of purchase requisitions. The Payroll Department had expenses of \($180,000,\) and the Purchasing Department had expenses of \($154,000\) for the year. The following annual data for Residential, Commercial, and Highway Divisions were obtained from corporate records:

a. Determine the amount of payroll and purchasing costs charged back to the Residential, Commercial, and Highway Divisions from payroll and purchasing services.

b. Why does the Residential Division have a larger service department charge than the other two divisions even though its sales are lower?

Step by Step Answer: