Tax Help Inc. was started on January 1, 2006. The company experienced the following events during its

Question:

Tax Help Inc. was started on January 1, 2006. The company experienced the following events during its first year of operation.

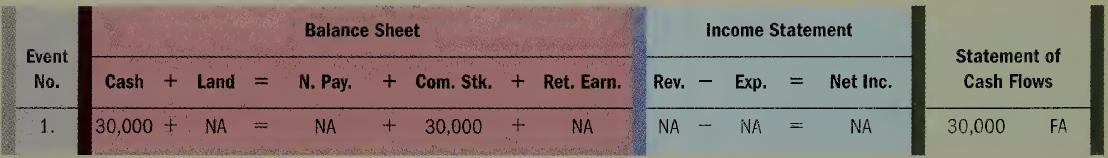

1. Acquired \($30,000\) cash from the issue of common stock.

2. Paid \($12,000\) cash to purchase land.

3. Received \($30,000\) cash for providing tax services to customers.

4. Paid \($9,500\) cash for salary expense.

5. Acquired \($5,000\) cash from the issue of additional common stock.

6. Borrowed \($10,000\) cash from the bank.

7. Purchased additional land for \($5,000\) cash.

8. Paid \($6,000\) cash for other operating expenses.

9. Paid a \($2,800\) cash dividend to the stockholders.

10.Determined the market value of the land to be \($18,000\).

Required:

a. Record these events in a horizontal statements model. Also, in the Cash Flows column, classify the cash flows as operating activities (OA), investing activities (IA), or financing activities (FA). The first event is shown as an example.

b. What is the net income earned in 2006?

c. What is the amount of total assets at the end of 2006?

d. What is the net cash flow from operating activities for 2006?

e. W hat is the net cash flow from investing activities for 2006?

f. What is the net cash flow from financing activities for 2006?

g. Wrhat is the cash balance at the end of 2006?

h. As of the end of the year 2006, what percentage of total assets was provided by creditors, investors, and earnings?

Step by Step Answer:

Survey Of Accounting

ISBN: 9780077503956

1st Edition

Authors: Thomas Edmonds, Philip Olds, Frances McNair, Bor-Yi Tsay