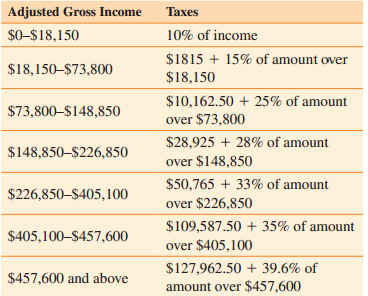

The federal income tax rate schedule for a joint return in 2014 is illustrated in the table

Question:

Transcribed Image Text:

Adjusted Gross Income Taxes $0-$18,150 10% of income $1815 + 15% of amount over $18,150-$73,800 $18,150 $10,162.50 + 25% of amount over $73,800 $73,800-$148,850 $28,925 + 28% of amount over $148,850 $148,850–$226,850 $50,765 + 33% of amount over $226,850 $226,850-$405,100 $109,587.50 + 35% of amount $405,100-$457,600 over $405,100 $127,962.50 + 39.6% of $457,600 and above amount over $457,600

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (10 reviews)

The family paid more than 1016250 but less tha...View the full answer

Answered By

Rinki Devi

Professional, Experienced, and Expert tutor who will provide speedy and to-the-point solutions.

Hi there! Are you looking for a committed, reliable, and enthusiastic tutor? Well, teaching and learning are more of a second nature to me, having been raised by parents who are both teachers. I have done plenty of studying and lots of learning on many exciting and challenging topics. All these experiences have influenced my decision to take on the teaching role in various capacities. As a tutor, I am looking forward to getting to understand your needs and helping you achieve your academic goals. I'm highly flexible and contactable. I am available to work on short notice since I only prefer to work with very small and select groups of students.

I have been teaching students for 5 years now in different subjects and it's truly been one of the most rewarding experiences of my life. I have also done one-to-one tutoring with 100+ students and helped them achieve great subject knowledge.

5.00+

2+ Reviews

10+ Question Solved

Related Book For

A Survey of Mathematics with Applications

ISBN: 978-0134112107

10th edition

Authors: Allen R. Angel, Christine D. Abbott, Dennis Runde

Question Posted:

Students also viewed these Mathematics questions

-

Refer to Exercise 19.24. Is there sufficient evidence to infer that people who work for themselves (WRKSLF: 1 = Self-employed, 2 = Work for someone else) differ from those who work for someone else...

-

Does age (AGE) affect ones belief concerning the federal income tax that one has to pay (TAX: Do you consider the amount of federal income tax that you have to pay as too high, about right, or too...

-

The Bureau of Labor Statistics reports that one use of the Consumer Price Index is to periodically adjust the federal income tax structure, which sets higher tax rates for higher income brackets....

-

Explain why an economic tradeoff exists between the number of trays and the reflux ratio.

-

Use Worksheet 11.2 to help Clayton and Julie Grover, a married couple in their early 40s, evaluate their securities portfolio, which includes these holdings. a. IBM. (NYSE; symbol IBM): 100 shares...

-

The two employees of Silver Co. receive various fringe benefits. Silver Co. provides vacation at the rate of $315 per day. Each employee earns one day of vacation per month worked. In addition,...

-

Consider the time to recharge the flash. The probability that a camera passes the test is 0.8, and the cameras perform independently. What is the probability that the third failure is obtained in...

-

Dillard Co. has sales revenue of $100,000, cost of goods sold of $70,000, and operating expenses of $18,000. What is its gross profit?

-

Calculate the missing information. Round dollars to the nearest cent and percents to the nearest tenth of a percent. Item Cost Amount of Markup Selling Price (in $) Percent Markup Based on Cost Bar...

-

Janice Morgan, age 24, is single and has no dependents. She is a freelance writer. In January 2021, Janice opened her own office located at 2751 Waldham Road, Pleasant Hill, NM 88135. She called her...

-

Which of the following SQL statements determines how many total customers were referred by other customers? a. SELECT customer#, SUM (referred) FROM customers GROUP BY customer#; b. SELECT COUNT...

-

Use the following SELECT statement to answer. 1 SELECT customer#, COUNT(*) 2 FROM customers JOIN orders USING (customer#) 3 WHERE orderdate > '02-APR-09' 4 GROUP BY customer# 5 HAVING COUNT(*) > 2;...

-

What is the difference between in-store and out-of-store promotions? What are some of the most common types of vehicles and how can they be promoted and tied to an IMC campaign?

-

Well, its my job that brought us here in the first place I am going to have to make a decision to stick with this assignment and hope I can work things out, or to return to the United States and...

-

The success of Japans Olympus was based largely on the corporate leadership system consensus driven, government supported, and rife with cronyismthat was successful when Japan was one of the...

-

Choose a company following a conglomerate diversification corporate strategy, such as Berkshire Hathaway, Reliance Industries, or Alibaba. Identify the extent to which its diversification strategy...

-

The above statements truly reflect HSBC Holdings (hereafter HSBC) massive and distinct operations in 2012 that maintained 89 million customers worldwide. Originally known as Hong Kong Shanghai...

-

How will Taiwanese company Hon Hai, better known as Foxconn Technology Group, which makes personal computers and smartphones for brands such as Apple, Dell, and Huawei, continue to prosper in the...

-

Compute the rate of net income before income taxes on total assets for each of these two years. Base your calculation on total ending assets each year. Canna, Inc. Comparative Income Statement Years...

-

Write an SQL statement to display all data on products having a QuantityOnHand greater than 0.

-

Construct a truth table for the statement. p ~q

-

A leap year has 366 days and a week has eight days if and only if an hour has 24 minutes. Determine the truth value of the statement.

-

Use an Euler diagram to determine whether the syllogism is valid or invalid. All yo-yos are toys. All Slinkies are toys. All Slinkies are yo-yos.

-

How do the resource descriptions (typing) used in the Incident Command System lead to a more effective response?

-

A company incurs $4172000 of overhead each year across three departments: Ordering and Receiving, Mixing, and Testing. The company prepares 2000 purchase orders, works 50000 mixing hours, and...

-

Hemming Company reported the following current-year purchases and sales for its only product. Date January 1 January 10 Activities Beginning inventory March 14 March 15 July 30 Sales Purchase Sales...

Study smarter with the SolutionInn App