When Godfrey died in 2018, his assets were valued as follows: The executor sold the stock two

Question:

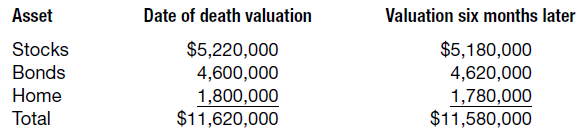

When Godfrey died in 2018, his assets were valued as follows:

The executor sold the stock two months after the decedent’s death for $5,200,000. The bonds were sold seven months after the decedent’s death for $4,630,000. What valuation should be used for the gross estate?

The executor sold the stock two months after the decedent’s death for $5,200,000. The bonds were sold seven months after the decedent’s death for $4,630,000. What valuation should be used for the gross estate?

Transcribed Image Text:

Date of death valuation Valuation six months later Asset $5,180,000 4,620,000 1,780,000 $11,580,000 Stocks Bonds Home Total $5,220,000 4,600,000 1,800,000 $11,620,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 46% (15 reviews)

11600000 Using the alternate valuation date gives a to...View the full answer

Answered By

Ali Khawaja

my expertise are as follows: financial accounting : - journal entries - financial statements including balance sheet, profit & loss account, cash flow statement & statement of changes in equity -consolidated statement of financial position. -ratio analysis -depreciation methods -accounting concepts -understanding and application of all international financial reporting standards (ifrs) -international accounting standards (ias) -etc business analysis : -business strategy -strategic choices -business processes -e-business -e-marketing -project management -finance -hrm financial management : -project appraisal -capital budgeting -net present value (npv) -internal rate of return (irr) -net present value(npv) -payback period -strategic position -strategic choices -information technology -project management -finance -human resource management auditing: -internal audit -external audit -substantive procedures -analytic procedures -designing and assessment of internal controls -developing the flow charts & data flow diagrams -audit reports -engagement letter -materiality economics: -micro -macro -game theory -econometric -mathematical application in economics -empirical macroeconomics -international trade -international political economy -monetary theory and policy -public economics ,business law, and all regarding commerce

4.00+

1+ Reviews

10+ Question Solved

Related Book For

Taxation For Decision Makers 2019

ISBN: 9781119497288

9th Edition

Authors: Shirley Dennis Escoffier, Karen A. Fortin

Question Posted:

Students also viewed these Business questions

-

When Godfrey died in 2013, his assets were valued as follows: The executor sold the stock two months after the decedent's death for $2,200,000. The bonds were sold seven months after the decedent's...

-

When Godfrey died in 2016, his assets were valued as follows: Asset Date of Death Valuation Valuation Six Months Later...

-

Aquatic Biotechnology Inc. (ABI) is a medium-sized, public company operating an aquaculture business in eastern Canada. The company has been in operation since the mid-1990s, and during the latter...

-

What are fintech risks?

-

Distinguish between atomic number and atomic weight.

-

What was the total amount removed from Joshuas estate in 2020? In 2019, Joshua gave $15,000 worth of Microsoft stock to his son. In 2020, the Microsoft shares were worth $23,000.

-

The Nielsen family formed their corporation, N. Robert Nielsen, Inc., to conduct farming operations. Morre, Grider & Co. is a certified public accounting firm that has provided accounting, tax, and...

-

Kohler Corporation reports the following components of stockholders equity on December 31, 2013: Common stock $ 10 par value, 100,000 shares authorized, 40,000 shares issued and outstanding . . . . ....

-

Why, in fact, does Marxism breed regimes which are totalitarian in nature? How does multiculturalism at play?

-

Ramirez Co. decides at the beginning of 2022 to adopt the FIFO method of inventory valuation. Ramirez has used the average-cost method for financial reporting since its inception on January 1, 2020,...

-

Your client, Ted, would like your assistance in selecting one of the following assets to give to his 16-year-old daughter. The corporate stock pays only $100 in dividend income each year but has...

-

Oscar (age 70) and Maggie (age 60) were married and jointly owned a personal residence valued at $3,800,000 when Oscar died in 2018. Oscar also owned stocks valued at $6,700,000; an art collection...

-

Sometimes an investigator wishes to decide whether a group of m predictors (m > 1) can simultaneously be eliminated from the model. The null hypothesis says that all s associated with these m...

-

Planet Fitness. Membership Fees Annual, Yearly, and Specials. Equipment does all planet fitnesses have the same membership?

-

What is a cross functional team? Discuss the benefits of a cross functional team. Use some examples of how they can improve overall productivity.

-

How does compensation relate to Quantitative within an organization? How does Employee Turnover relate to Qualitative within an organization?

-

What types of laws or regulations do the state Connecticut control regarding healthcare?

-

Before anyone begins to plan a meeting, they need to know what services are available in their community. Gather information on various social service agencies in your community. Internet searches...

-

When a charged particle enters a region of uniform magnetic field, it follows a circular path, as indicated in FIGURE 22-44. (a) Is this particle positively or negatively charged? Explain. (b)...

-

Frontland Advertising creates, plans, and handles advertising campaigns in a three-state area. Recently, Frontland had to replace an inexperienced office worker in charge of bookkeeping because of...

-

If you were considering introducing robots in your manufacturing plant, what management, organization, and technology issues would you need to address?

-

How powerful is Watson? Describe its technology. Why does it require so much powerful hardware?

-

How intelligent is Watson? What can it do? What can?t it do?

-

What are the cellular and molecular mechanisms underlying neuronal development and axon guidance, including the roles of axon guidance cues, cell adhesion molecules, and cytoskeletal dynamics in...

-

CREATING A CRIMINAL LAW CASE About Fraud IN CANADA In this assessment, you will demonstrate your understanding of criminal law and criminal law procedure by creating case scenario. create "facts",...

-

How do neuromodulatory systems such as the dopaminergic, serotonergic, and cholinergic systems regulate mood, motivation, and cognitive function through widespread projections and interactions with...

Study smarter with the SolutionInn App