Cartman Corporation owns 90 shares of SP Corporation. The remaining 10 shares are owned by Kenny (an

Question:

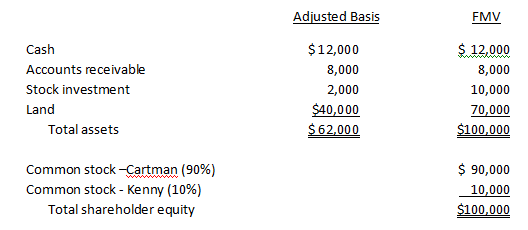

a. Compute the gain or loss recognized by SP, Cartman, and Kenny on a complete liquidation of the corporation where SP distributes $10,000 of cash to Kenny and the remaining assetsto Cartman.

b. Compute the gain or loss recognized by SP, Cartman,and Kenny on a complete liquidation of the corporation where SP distributes the stock investment to Kenny and the remaining assets to Cartman. Assume that SP€™s tax rate is zero.

c. What form needs to be filed with the liquidation of SP?

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Liquidation

Liquidation in finance and economics is the process of bringing a business to an end and distributing its assets to claimants. It is an event that usually occurs when a company is insolvent, meaning it cannot pay its obligations when they are due....

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Taxation Of Business Entities 2018 Edition

ISBN: 9781260174441

9th Edition

Authors: Brian C. Spilker, Benjamin C. Ayers, John A. Barrick, Edmund Outslay, John Robinson, Connie Weaver Ronald G. Worsham

Question Posted: