Rocco operates a beauty salon as a sole proprietorship. Rocco also owns and rents an apartment building.

Question:

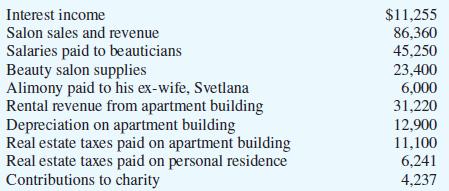

Rocco operates a beauty salon as a sole proprietorship. Rocco also owns and rents an apartment building. In 2022, Rocco had the following income and expenses. Determine Rocco’s AGI and complete page 1 (through line 11) and Schedule 1 of Form 1040 for Rocco. You may assume that Rocco will owe $2,502 in self-employment tax on his salon income, with $1,251 representing the employer portion of the self-employment tax. You may also assume that his divorce from Svetlana was finalized in 2016.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Taxation Of Individuals And Business Entities 2023 Edition

ISBN: 9781265790295

14th Edition

Authors: Brian Spilker, Benjamin Ayers, John Barrick, Troy Lewis, John Robinson, Connie Weaver, Ronald Worsham

Question Posted: