Ae and Bee commenced in partnership on 1 July 2018 preparing accounts to 30 June. Cae joined

Question:

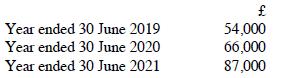

Ae and Bee commenced in partnership on 1 July 2018 preparing accounts to 30 June. Cae joined as a partner on 1 July 2020. Profits have always been shared equally. The partnership’s trading profits since the commencement of trading have been as follows:

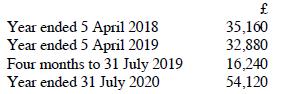

Dee commenced in self-employment on 6 April 2017. She initially prepared accounts to 5 April, but changed her accounting date to 31 July by preparing accounts for the four month period to 31 July 2019. Dee’s trading profits since she commenced trading have been as follows:

Required:

(a) Calculate the trading income assessments of Ae, Bee and Cae for each of the tax years 2018-19, 2019-20 and 2020-21.

(b) Calculate the amount of trading profits that will have been assessed on Dee for each of the tax years 2018-19, 2019-20 and 2020-21.

(c) State the amount of Dee’s unrelieved overlap profits as at 5 April 2021.

Step by Step Answer: