Esm receives dividends of 17,000 in 2017-18 and has no other income. She makes a gross deductibl

Question:

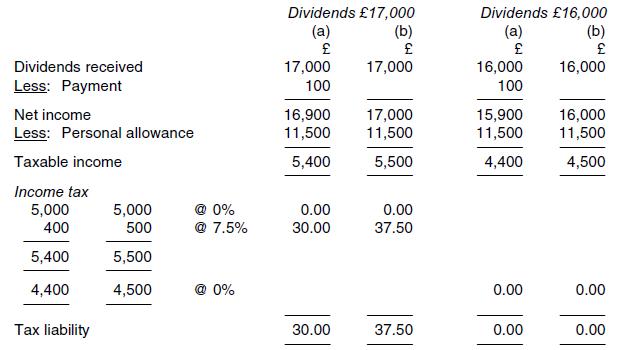

Esmé receives dividends of £17,000 in 2017-18 and has no other income. She makes a gross deductibl e payment of £10 0 during the year and claims only the basic personal allowance. Calculate Esmé's tax liability for the year:

(a) with the deductible payment

(b) as it would have been without the payment.

How would the situation differ if her dividend income had been £1,000 lower?

Transcribed Image Text:

Dividends received Less: Payment Net income Less: Personal allowance Taxable income Income tax 5,000 400 5,400 4,400 Tax liability 5,000 500 5,500 4,500 @ 0% @ 7.5% @ 0% Dividends 17,000 (a) 17,000 100 16,900 11,500 5,400 0.00 30.00 30.00 (b) 17,000 17,000 11,500 5,500 0.00 37.50 37.50 Dividends 16,000 (a) 16,000 100 15,900 11,500 4,400 0.00 0.00 (b) 16,000 16,000 11,500 4,500 0.00 0.00

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

Notes i With dividends of 17000 Esms highest rate of tax is the dividend ...View the full answer

Answered By

Sidharth Jain

My name is Sidharth. I completed engineering from National Institute of Technology Durgapur which is one of the top college in India. I am currently working as an Maths Faculty in one of the biggest IITJEE institute in India. Due to my passion in teaching and Maths, I came to this field. I've been teaching for almost 3 years.

Apart from it I also worked as an Expert Answerer on Chegg.com. I have many clients from USA to whom I teach online and help them in their assignments. I worked on many online classes on mymathlab and webassign. I guarantee for grade 'A'.

4.90+

3+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Since Ryanair DAC's2 emergence as an upstart challenger to the Aer Lingus Ltd.-British Airways plc duopoly in the late 1980s, it had been both a consumer champion and antagonist; a technological...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

The U.S. Court of Appeals for the Fourth Circuit affirmed the lower court ruling in the case Public Employees Retirement Association of Colorado; Generic Trading of Philadelphia, LLC v. Deloitte...

-

Use the test of your choice to determine whether the following series converge. 1 + 1.3 1 3.5 + 1 5.7

-

Refer to the Fischer projection of D-(+)-xylose in Figure 25.2 (Section 25.4) and give structural formulas for (a) (-)-Xylose (Fischer projection) (b) D-Xylitol (c) -D-Xylopyranose (d)...

-

The report ?Education Pays 2016? (The CollegeBoard, trends.collegeboard.org/sites/default ? /files/education-pays-2016-full-report.pdf, retrieved May 27, 2017) provided information on education level...

-

Prove that, for \(\delta>2\), the default of martingality of \(R^{2-\delta}\) (where \(R\) is a Bessel process of dimension \(\delta\) starting from \(x\) ) is given by...

-

The New England Cheese Company produces two cheese spreads by blending mild cheddar cheese with extra sharp cheddar cheese. The cheese spreads are packaged in 12-ounce containers, which are then sold...

-

A company has decided to revamp the security for its IT infrastructure and tighten rules for access to AWS resources across the organization. In this context, a Security Engineer has been tasked with...

-

In 2017-18, a taxpayer who pays income tax at 45% and capital gains tax at 20 % gives listed shares with a market value of 20,000 to a charity. There are no incidental costs of disposal and the...

-

Derek's total income for 2017-18 is 63,310 (entirely non-savings) and he makes a gross deductible payment of 3,000 in the year. He is not a Scottish taxpayer and he makes no Gift Aid donations or...

-

A die is rolled two times. Provide a list of the possible outcomes of the two rolls in this form: the result from the first roll and the result from the second roll.

-

For the following statements, circle "T" for true and "F" for false: 1. Competitiveness means how effectively an organization meets the wants and needs of customers relative to others that offer...

-

on 2.The figure below displays the phase diagram. Identify all phase reactions that can happen (Show detailed analysis) [6] Temperature (C) 1400 1200 1000 800 600 R 5+1 20 a+p 40 4 4 42 40 7+1 7+ B...

-

To find a position vector between two arbitrary points. As shown, two cables connect three points. C is below A by a distance C = 2.30 ft and connected to A by a cable 12.1 ft long. Cable AC forms an...

-

3. What is the maximum energy transfer that a 1 MeV neutron can transfer in an elastic scattering event to an atom in the solid if this atom is (i) H, (ii) C-12, (iii) Fe-56 and (iv) U-238?

-

Rewrite the complex numbers shown below in the form of: y = Mejo a. y = 4+1j b. c. y = 4-1j d. y = 4+1j y = 4+1j

-

What kinds of resource allocation approaches discussed in the chapter were used in this situation?

-

DC has unused FTC carryover from 2017 in the separate category for GC income as the result of income generated by a foreign branch. The income was foreign source general category income. In 2018 the...

-

A company enters into 10,000 contracts with customers, all on the same date. These contracts have very similar characteristics and therefore (as a practical expedient) the company decides to apply...

-

A company is contracted to build an asset for a customer. The contract price is 5m but the contract stipulates that the company will receive an incentive payment of a further 1m if the asset is...

-

Define the term "revenue". Also explain the "five-step model" for the recognition and measurement of revenue which is set out in international standard IFRS15.

-

A company provided the following data: Sales Variable costs Fixed costs Expected production and sales in units $600,000 380,000 150,000 45,000 units How much sales in dollars is necessary to generate...

-

On September 1, Hydra purchased $13,300 of inventory items on credit with the terms 1/15, net 30, FOB destination. Freight charges were $280. Payment for the purchase was made on September 18....

-

An entity started construction on a building for its own use on 1 April 20X7 and incurred the following costs: $000 Purchase price of land 250,000 Stamp duty Legal fees 5,000 10,000 Site preparation...

Study smarter with the SolutionInn App