In 2020-21, an employer provides living accommodation for an employee. The employer also provides the following services

Question:

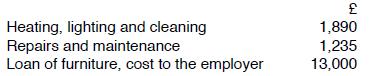

In 2020-21, an employer provides living accommodation for an employee. The employer also provides the following services in connection with this accommodation:

The employee contributes £100 each month towards these services and has net earnings for the year (excluding the ancillary services) of £42,500. Compute the taxable benefit.

Transcribed Image Text:

Heating, lighting and cleaning Repairs and maintenance Loan of furniture, cost to the employer 1,890 1,235 13,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (1 review)

If the accommodation is not jobrelated ...View the full answer

Answered By

Amit Kumar

I am a student at IIT Kanpur , which is one of the prestigious colleges in INDIA.

Cleared JEE Advance in 2017.I am a flexible teacher because I understand that all students learn in different ways and at different paces. When teaching, I make sure that every student has a grasp of the subject before moving on.

I will help student to get the basic understanding clear. I believe friendly behavior with student can help both the student and the teacher.

I love science and my students do the same.

4.90+

44+ Reviews

166+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Read the case study "Southwest Airlines," found in Part 2 of your textbook. Review the "Guide to Case Analysis" found on pp. CA1 - CA11 of your textbook. (This guide follows the last case in the...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

The CRA considers discounts to be taxable in all of the following situation : Question 17 options: An employer make an arrangement that allows an employee to buy merchandise (other than old or soiled...

-

If a price ceiling or price floor existed where you lived, would you be willing to purchase products on the black market? What would you identify as a consequence to engaging in transactions on the...

-

A particle starts from rest and accelerates as shown in Figure P2.12. Determine (a) The particles speed at t = 10.0 s and at t = 20.0 s, and (b) The distance traveled in the first 20.0 s.

-

John and Kathy Brown have just been audited and the IRS agent disallowed the business loss they claimed in 2021. The agent asserted that the activity was a hobby, not a business. John and Kathy live...

-

How is default risk mitigated in a futures contract?

-

What are the major implications for the business manager if an assessment of current practices indicates substantial inconsistency in the information vision and IT architecture for the company? What...

-

10. A skier plans to ski a smooth fixed hemisphere of radius R. He starts form rest on a curved smooth surface of height TR/4 The angle at which he leaves the hemisphere is : (a) cos Yshipma (b) cos...

-

(a) Throughout the whole of tax year 2020-21, Lucy is provided by her employer with a car with a list price of 27,400. The car was first registered in March 2020 and is not dieseldriven. Lucy...

-

On 6 April 2018, an employer purchases a music system for 800 and immediately lends the system to an employee for his private use. The system remains in the employee's possession until 6 October 2020...

-

On Friday night, the owner of Chez Pierre in downtown Chicago noted the amount spent for dinner for 28 four-person tables. (a) Find the mean, median, and mode. (b) Do these measures of center agree?...

-

The bonds of Simons, Inc. carry a 89 monthly coupon and mature in six years. Bonds of equivalent risk yield 9.5% What is the market value of Simons's bonds? (4 points) The bonds of Simons, Inc. carry...

-

The entity conducted an independent appraisal of the value of its real estate in accordance with previously applicable national rules. The entity's financial analysts determined that the values had...

-

At the beginning of March, Carla Vista Software Company had Cash of $11,742, Accounts Receivable of $18.483, Accounts Payable of $4,065, and G. Carla Vista, Capital of $26.160. During the month of...

-

Apply Euler's method by hand with N = 4 to find yo, Y1, Y2, Y3, Y4 on [0,1] where Y' y' = - 2y + 3t y(0) =1 Note: Please don't use Python for this. You are allowed to use a calculator do the...

-

A class survey in a large class for first-year college students asked, "About how many minutes do you study on a typical weeknight?" The mean response of the 160 students was x = 135 minutes. Suppose...

-

On January 1, 2010, Housen Company issued 10-year bonds of $500,000 at 102. Interest is payable on January 1 and July 1 at 10%. On April 1, 2011, Housen Company reacquires and retires 50 of its own...

-

Find the radius of convergence of? 1.2.3 1.3.5 (2n-1) r2n+1 -1

-

(a) Explain what is meant by the term "joint arrangement". (b) Distinguish between joint operations and joint ventures. Outline the accounting treatment prescribed for each of these by standard...

-

(a) Explain what is meant by the terms "associate" and "significant influence". (b) Explain the equity method of accounting which is used to account for an investment in an associate. Also explain...

-

On 1 October 2019 Pumice acquired the following non-current investments: (i) 80% of the equity share capital of Silverton at a cost of 13. 6 million (ii) 50% of Silverton's 10% loan notes at par...

-

Teams need both task - oriented and social - oriented roles to function effectively Distributing tasks based on individual strengths is crucial for success The pilot with the most aircraft - specific...

-

20% through organic online search. 11% through print advertising. 46% Google Ads (online advertisements in Facebook, Google searches, etc.). 6% radio advertising. These results were compared to the...

-

Amazon realized it could achieve a competitive advantage by addressing a key problem before its competitors. How did Amazon recogniz it needed recommendations?

Study smarter with the SolutionInn App