In August 2020, Samuel sold 20,000 ordinary shares in WQZ Ltd for 8 each. He had bought

Question:

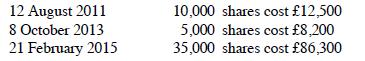

In August 2020, Samuel sold 20,000 ordinary shares in WQZ Ltd for £8 each. He had bought shares in the company as follows:

WQZ Ltd is an unlisted trading company with an issued share capital consisting of 120,000 ordinary shares, all of which have equal voting rights.

Samuel has been a director of WQZ Ltd since 2013. He claims business asset disposal relief (BADR) in relation to the share disposal and has never claimed the relief before. He has no other disposals in 2020-21 and has no allowable losses brought forward.

You are required to:

(i) Calculate the gain arising in August 2020.

(ii) Explain why this gain is eligible for business asset disposal relief.

(iii) Calculate Samuel's CGT liability for 2020-21 and state the due date of payment.

Step by Step Answer: