Jeremy acquired the following ordinary shares in Scarlon plc: He made no further acquisitions during 2021. On

Question:

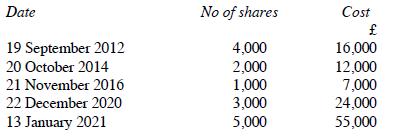

Jeremy acquired the following ordinary shares in Scarlon plc:

He made no further acquisitions during 2021. On 22 December 2020, he sold 10,000 shares in the company for £10 per share. Calculate the chargeable gain or allowable loss arising on this disposal.

Transcribed Image Text:

Date 19 September 2012 20 October 2014 21 November 2016 22 December 2020 13 January 2021 No of shares 4,000 2,000 1,000 3,000 5,000 Cost 16,000 12,000 7,000 24,000 55,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

The 10000 shares disposed of on 22 December 2020 are matched as follows a The first match is against ...View the full answer

Answered By

Somshukla Chakraborty

I have a teaching experience of more than 4 years by now in diverse subjects like History,Geography,Political Science,Sociology,Business Enterprise,Economics,Environmental Management etc.I teach students from classes 9-12 and undergraduate students.I boards I handle are IB,IGCSE, state boards,ICSE, CBSE.I am passionate about teaching.Full satisfaction of the students is my main goal.

I have completed my graduation and master's in history from Jadavpur University Kolkata,India in 2012 and I have completed my B.Ed from the same University in 2013. I have taught in a reputed school of Kolkata (subjects-History,Geography,Civics,Political Science) from 2014-2016.I worked as a guest lecturer of history in a college of Kolkata for 2 years teaching students of 1st ,2nd and 3rd year. I taught Ancient and Modern Indian history there.I have taught in another school in Mohali,Punjab teaching students from classes 9-12.Presently I am working as an online tutor with concept tutors,Bangalore,India(Carve Niche Pvt.Ltd.) for the last 1year and also have been appointed as an online history tutor by Course Hero(California,U.S) and Vidyalai.com(Chennai,India).

4.00+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Jeremy acquired the following ordinary shares in Scarlon plc: He made no further acquisitions during 2022. On 22 December 2021, he sold 10,000 shares in the company for 10 per share. Calculate the...

-

Jeremy acquired the following ordinary shares in Scarlon plc: Date 19 September 2009 20 October 2011 21 November 2013 22 December 2017 13 January 2018 No of shares 4,000 2,000 1,000 3,000 5,000 Cost...

-

On 15 October 2017, Desmond bought 5 000 shares in Red Ltd at a cost of R5 per share. On 25 October 2018, Red Ltd was taken over by Blue plc. The shareholders of Red Ltd received 3 shares in Blue plc...

-

A potential difference of 1.20 V will be applied to a 33.0 m length of 18-gauge copper wire (diameter = 0.0400 in.). Calculate (a) The current, (b) The magnitude of the current density, (c) The...

-

Cathy Benson, the director of the newly created IT Investment Office, is tasked with the "design and implementation of a detailed investment optimization process to be implemented throughout the bank...

-

Three particles each carrying charge \(+q\) are located at the corners of an equilateral triangle whose side length is \(a\). The triangle is centered on the origin of a Cartesian coordinate system....

-

At the end of the financial year ended 30 June 2025, the trial balance of Carol, Caitlin and Christie is as shown below. Christie made her advance before 1 July 2024. Carol and Caitlin each withdrew...

-

On January 1, 2014, Access IT Company exchanged $1,000,000 for 40 percent of the outstanding voting stock of Net Connect. Especially attractive to Access IT was a research project underway at Net...

-

Kazibwe, a businessman does not maintain a complete set of books for his business transactions. The following is a summary of his cash transactions for the year ended December 31, 2015. Receipts Kshs...

-

William made the following acquisitions of preference shares in Pangol plc: In January 2020, the company made a 1 for 4 bonus issue. In February 2021, William sold 450 shares for 4 per share....

-

Sandra acquired the following ordinary shares in Pincer plc: On 26 June 2020, Sandra sold 700 of her shares in Pincer plc. Assuming that she acquired no further shares in the company during 2020,...

-

The center-to-center distance between a \(200 \mathrm{~g}\) lead sphere and an \(800 \mathrm{~g}\) lead sphere is \(0.120 \mathrm{~m}\). A \(1.00 \mathrm{~g}\) object is placed \(0.0800 \mathrm{~m}\)...

-

What drivers of the retail industry are affecting Pick n Pay? Explain.

-

A couple, Randall and Beth (both age 30) have come to see you regarding their financial situation. Randall works for a consulting firm earning $180,000 per annum. Beth is currently a stay home mother...

-

In order to explain the US defense budget, you are using the data from 1962 to 1981 with the following variables (all measured in billions USD) and estimate the corresponding model (Model 1):(Use...

-

List and describe 10 common account enquiries you may be required to review when working within financial services

-

Define SSEs. How do you start and scale SSEs. What are the problems that are facing by SSEs in the world today.

-

1. What does that mean? 2. Does that leave the Lees without any legal remedy?

-

For liquid water the isothermal compressibility is given by; where r and b are functions of temperature only. If 1 kg of water is compressed isothermally and reversibly from I to 500 bar at 60(C. how...

-

Suzanne acquired the following ordinary shares in Quarine plc: Date 2 October 1979 10 January 1981 5 December 2001 8 November 2008 24 July 2017 10 August 2017 20 August 2017 31 August 2017 No of...

-

In June 201 6, Walter bought 10 ,000 shares in Ovod plc at a cost of 7 per share. In September 2017 , Rundico plc made a takeover bid for Ovod plc, offering the Ovod shareholders eight Rundico shares...

-

Tina made the following acquisitions of ordinary shares in Hombus plc: Date 15 August 1993 23 January 2003 Number of shares 500 700 Cost 1,250 2,800 On 1 June 2014, the company made a 1 for 20 rights...

-

Two squirrels are sitting on the rope as shown. The squirrel at A has a weight of 1.2 lb. The squirrel at B found less food this season and has a weight of 0.95 lb. The angles 0 and are equal to 43.5...

-

5. The 2-in.-diameter solid circular column shown below is made of structural steel [E= 29,000 ksi and a = 6.6 x 10-6/F]. If the column is initially stress free, determine the temperature increase...

-

It is important for the cost analyst to review the requirements document and request for proposal because: A. any cost not specified in the RFP is unallowable. B. such review is critical to...

Study smarter with the SolutionInn App