XYZ is a calendar-year corporation that began business on January 1, 2014. For 2014, it reported the

Question:

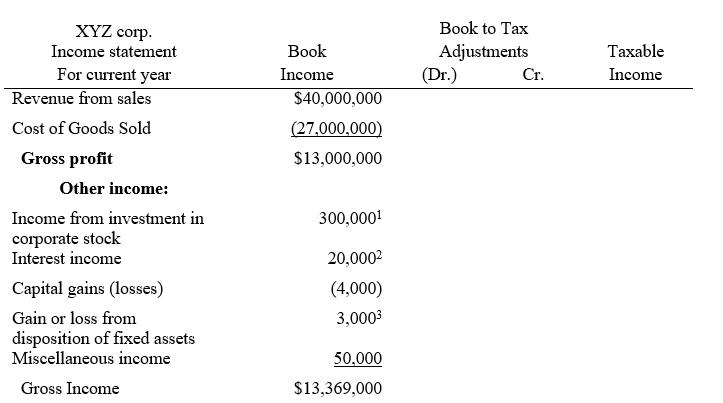

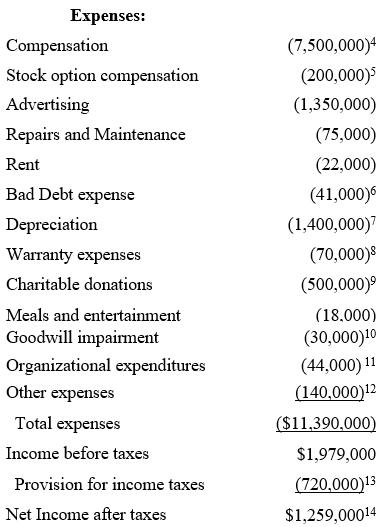

XYZ is a calendar-year corporation that began business on January 1, 2014. For 2014, it reported the following information in its current year audited income statement. Notes with important tax information are provided below.

Required:

a. Reconcile book income to taxable income and identify each book-tax difference as temporary or permanent.

b. Compute XYZ’s regular income tax liability.

c. Complete XYZ’s Schedule M-1.

d. Complete XYZ’s Form 1120, page 1 (use 2013 form if 2014 form is unavailable). Ignore estimated tax penalties when completing the form.

e. Compute XYZ’s alternative minimum tax, if any.

f. Complete a Form 4626 for XYZ (use 2013 version if 2014 is unavailable).

g. Determine the quarters for which XYZ is subject to underpayment of estimated taxes penalties (see estimated tax information below).

Notes:

1. XYZ owns 30% of the outstanding Hobble Corp. (HC) stock. Hobble Corp. reported $1,000,000 of income for the year. XYZ accounted for its investment in HC under the equity method and it recorded its pro rata share of HC’s earnings for the year. HC also distributed a $200,000 dividend to XYZ.

2. Of the $20,000 interest income, $5,000 was from a City of Seattle bond (issued in 2013) that was used to fund public activities, $7,000 was from a Tacoma City bond (issued in 2012) used to fund private activities, $6,000 was from a fully taxable corporate bond, and the remaining $2,000 was from a money market account.

3. This gain is from equipment that XYZ purchased in February and sold in December (that is, it does not qualify as §1231 gain).

4. This includes total officer compensation of $2,500,000 (no one officer received more than $1,000,000 compensation).

5. This amount is the portion of incentive stock option compensation that vested during the year (recipients are officers).

6. XYZ actually wrote off $27,000 of its accounts receivable as uncollectible.

7. Regular tax depreciation was $1,900,000 and AMT (and ACE) depreciation was $1,700,000.

8. In the current year, XYZ did not make any actual payments on warranties it provided to customers.

9. XYZ made $500,000 of cash contributions to qualified charities during the year.

10. On July 1 of this year XYZ acquired the assets of another business. In the process it acquired $300,000 of goodwill. At the end of the year, XYZ wrote off $30,000 of the goodwill as impaired.

11. XYZ expensed all of its organizational expenditures for book purposes. It expensed the maximum amount of organizational expenditures allowed for tax purposes.

12. The other expenses do not contain any items with book-tax differences.

13. This is an estimated tax provision (federal tax expense) for the year. Assume that XYZ is not subject to state income taxes.

14. XYZ calculated that its domestic production activities deduction (DPAD) is $90,000. This amount is not included on the audited income statement numbers.

Estimated tax information:

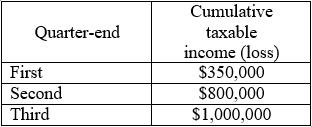

XYZ made four equal estimated tax payments totaling $480,000. Assume for purposes of estimated tax penalties, XYZ was in existence in 2013 and it reported a tax liability of $800,000. During 2014, XYZ determined its taxable income at the end of each of the four quarters as follows:

Finally, assume that XYZ is not a large corporation for purposes of estimated tax calculations.

Step by Step Answer:

Taxation Of Individuals And Business Entities 2015

ISBN: 9780077862367

6th Edition

Authors: Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver