Frances paid income tax and Class 4 NICs of 47,000 for tax year 2020-21, of which 19,000

Question:

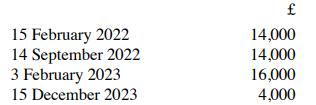

Frances paid income tax and Class 4 NICs of £47,000 for tax year 2020-21, of which £19,000 was paid via the PAYE system. Her total liability for 2021-22 is £69,000, of which £21,000 is paid via PAYE. Her payments for 2021-22 are as follows:

Calculate the late payment penalties and interest payable for the year, assuming that any penalties are paid on 15 December 2023 and that interest is charged at 2.6% p.a.

Also assume that the current late payment penalty system applies throughout.

Transcribed Image Text:

15 February 2022 14 September 2022 3 February 2023 15 December 2023 14,000 14,000 16,000 4,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (3 reviews)

To calculate the late payment penalties and interest we need to understand the UKs selfassessment tax payment system and the penalties associated with late payments Here is the general system of late ...View the full answer

Answered By

Nicholas Maina

Throughout my tutoring journey, I've amassed a wealth of hands-on experience and honed a diverse set of skills that enable me to guide students towards mastering complex subjects. My proficiency as a tutor rests on several key pillars:

1. Subject Mastery:

With a comprehensive understanding of a wide range of subjects spanning mathematics, science, humanities, and more, I can adeptly explain intricate concepts and break them down into digestible chunks. My proficiency extends to offering real-world applications, ensuring students grasp the practical relevance of their studies.

2. Individualized Guidance:

Recognizing that every student learns differently, I tailor my approach to accommodate various learning styles and paces. Through personalized interactions, I identify a student's strengths and areas for improvement, allowing me to craft targeted lessons that foster a deeper understanding of the material.

3. Problem-Solving Facilitation:

I excel in guiding students through problem-solving processes and encouraging critical thinking and analytical skills. By walking learners through step-by-step solutions and addressing their questions in a coherent manner, I empower them to approach challenges with confidence.

4. Effective Communication:

My tutoring proficiency is founded on clear and concise communication. I have the ability to convey complex ideas in an accessible manner, fostering a strong student-tutor rapport that encourages open dialogue and fruitful discussions.

5. Adaptability and Patience:

Tutoring is a dynamic process, and I have cultivated adaptability and patience to cater to evolving learning needs. I remain patient through difficulties, adjusting my teaching methods as necessary to ensure that students overcome obstacles and achieve their goals.

6. Interactive Learning:

Interactive learning lies at the heart of my approach. By engaging students in discussions, brainstorming sessions, and interactive exercises, I foster a stimulating learning environment that encourages active participation and long-term retention.

7. Continuous Improvement:

My dedication to being an effective tutor is a journey of continuous improvement. I regularly seek feedback and stay updated on educational methodologies, integrating new insights to refine my tutoring techniques and provide an even more enriching learning experience.

In essence, my hands-on experience as a tutor equips me with the tools to facilitate comprehensive understanding, critical thinking, and academic success. I am committed to helping students realize their full potential and fostering a passion for lifelong learning.

4.90+

5+ Reviews

16+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

Dorothy's income tax and Class 4 NICs liability for 2020-21 was 24,600, of which 600 was deducted at source. Her liability for 2021-22 is 28,000, of which none is deducted at source. She made a first...

-

Explain the meaning of the terms emoluments, employments and office for the purposes of PAYE as you earn systems. 2. Explain the actual receipts basis of assessing the emoluments from the employment...

-

Recruitment and selection involves the following except: a) building a pool of candidates. b) applicants completing application forms. c) downsizing the organization. d) employment planning and...

-

Medical researchers have developed a new artificial heart constructed primarily of titanium and plastic. The heart will last and operate almost indefinitely once it is implanted in the patients body,...

-

Step 1: Start up Integrated Accounting 8e. Step 2: Load opening balances file IA8 Problem 03-A. Step 3: Enter your name in the Your Name text box and click OK. Step 4: Save the file with a file name...

-

There are 24,627 species of fish on Earth. Decide whether the statement makes sense (or is clearly true) or does not make sense (or is clearly false). Explain clearly.

-

Foren Corporation had the following transactions pertaining to debt investments. Jan. 1 Purchased 50 8%, $1,000 Choate Co. bonds for $50,000 cash plus brokerage fees of $900. Interest is payable...

-

Training Set income sex low male yes Assume that the following training set and the test set are given for carBought function. married carBought yes Test Set income sex married carBought low male no...

-

Compute the primary and secondary Class 1 NICs payable in relation to the following employees: (a) A earns 198 for the week ending 25 June 2021. (b) B earns 803 for the week ending 25 June 2021. (c)...

-

Jabran did not receive a notice to file a tax return for 2020-21 but he was aware that he had income which had not been assessed to tax. He notified HMRC of this fact on 2 October 2021 and a return...

-

What is the purpose of the textOff attribute of a ToggleButton element?

-

A runner completes the 200-meter dash with a time of 19.28 seconds. What was the runner's average speed in meters per second? What was the runner's average speed in miles per hour?

-

E-Eyes.com just issued some new preferred stock. The issue will pay an annual dividend of $19 in perpetuity, beginning 8 years from now. If the market requires a 9 percent return on this investment,...

-

Mountain View Landscaping provided landscaping services for Mile High Condominiums. Mile High Condominiums paid Mountain View Landscaping $12,000 in advance for a landscaping service contract that...

-

Metallica Bearings, Inc., is a young start-up company. No dividends will be paid on the stock over the next 12 years because the firm needs to plow back its earnings to fuel growth. The company will...

-

Bond X is a ten-year semi-annual coupon bond, which was issued at par 7 years ago. The yield to maturity 7 years ago was 6%. How much does Bond X worth currently when the yield to maturity is 8% now....

-

Hales Company produces a product that requires two processes. In the first process, a subassembly is produced (subassembly A). In the second process, this subassembly and a subassembly purchased from...

-

Repeat the previous problem, but close the positions on September 20. Use the spreadsheet to find the profits for the possible stock prices on September 20. Generate a graph and use it to identify...

-

Outline the structure of an international standard (IFRS Standard or IAS Standard).

-

Explain the purpose of accounting standards (whether national or international) and identify the advantages that stem from the standardisation of accounting practice. Are there any disadvantages?

-

A company adopts international standards for the first time when preparing its financial statements for the year to 30 June 2018. These financial statements show comparative figures for the previous...

-

The radiology department at St. Joseph's Hospital, a not-for-profit, is considering purchasing a magnetic resonance imaging (MRI) machine. The cost to purchase and install an MRI is approximately...

-

For the following models, determine whether they are stationary or not. If yes, calculate their autocovariance functions (ACFs), that is, Yo, Y1, V2, .. (a) DGP1: yt = 0.75yt-1+ Et (b) DGP2: Yt =...

-

Coore Manufacturing has the following two possible projects. The required return is 13 percent. Year Project Y Project Z 0 -$28,600 -$51,000 1 14,600 14,000 2 13,000 37,000 3 15,400 12,000 4 11,000...

Study smarter with the SolutionInn App