Calculation practice: Paired t-test. Can the death rate be influenced by tax incentives? Kopczuk and Slemrod (2003)

Question:

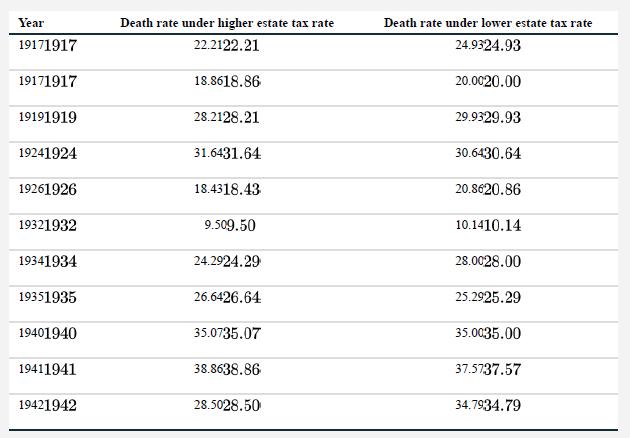

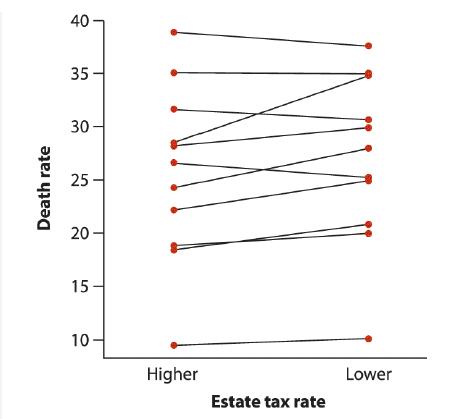

Calculation practice: Paired t-test. Can the death rate be influenced by tax incentives? Kopczuk and Slemrod (2003) investigated this possibility using data on deaths in the United States in years in which the government announced it was changing (usually raising) the tax rate on inheritance (the estate tax). The authors calculated the death rate during the 14 days before, and the 14 days after, the changes in the estate tax rates took effect. The number of deaths per day for each of these periods is given in the table at right. The data are illustrated in the strip chart on the next page (paired observations are connected by line segments).

Let’s use a paired t-test to ask whether the death rate changed significantly after the estate tax rate change.

a. State the null and alternate hypotheses for this analysis.

b. Why might a paired t-test be an appropriate method to apply to this comparison?

c. For each change in the estate tax, calculate the difference in death rate between the higher and lower tax regimes.

d. What is the mean of this difference?

e. What is the standard deviation of the difference?

f. What is the sample size?

g. What is the standard error of the mean difference?

h. Calculate tt for this test.

i. How many degrees of freedom will this paired t-statistic have?

j. What is the critical value for the test, corresponding to α=0.05?

k. What is the P-value associated with the test statistic, and what is the conclusion from the test?

l. What scientific conclusion do you draw from these findings?

Step by Step Answer:

The Analysis Of Biological Data

ISBN: 9781319226237

3rd Edition

Authors: Michael C. Whitlock, Dolph Schluter