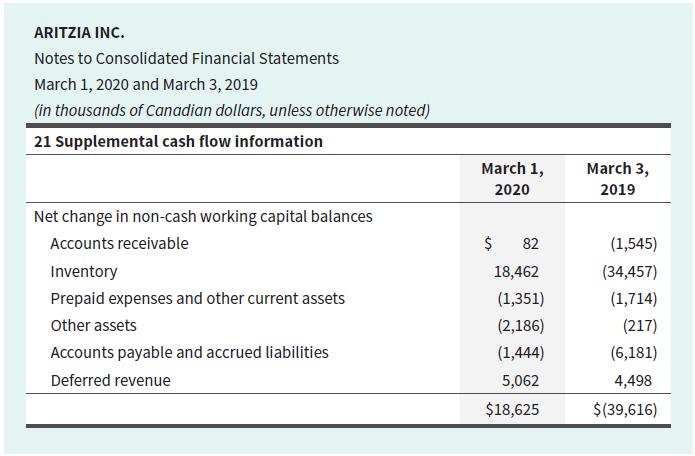

Exhibits 5.21B and contain the consolidated statements of cash flows and related note disclosure for Aritzia Inc.

Question:

Exhibits 5.21B and contain the consolidated statements of cash flows and related note disclosure for Aritzia Inc.

Required

a. In total, how much did Aritzia’s cash and cash equivalents change during 2020? Was this an increase or a decrease? How did this compare with the previous year?

b. Did Aritzia have net income or a net loss in 2020? How did this compare with the cash flows from operating activities? What was the largest difference between these two amounts?

c. What effect did the change in the company’s accounts payable and accrued liabilities have on cash flows from operating activities in 2020? What does this tell you about the balance owed to these creditors?

d. What effect did the change in the company’s inventory have on cash flows from operating activities in 2020? What does this tell you about the company’s inventory balance at the end of the current year relative to the prior one?

e. Did Aritzia purchase property and equipment during 2020? Did the company receive any proceeds from the sale of property and equipment during the period?

f. Calculate Aritzia’s net free cash flow for 2020 and 2019. Is the trend positive or negative?

g. Arizia’s current liabilities were $153,843 at March 1, 2020, and $90,611 at March 3, 2019. Determine the company’s operating cash flow ratio. Comment on the change year over year.

h. If you were a user of Aritzia’s financial statements—a banker or an investor—how would you interpret the company’s cash flow pattern? How would you assess the risk of a loan to or an investment in Aritzia? Do you think the company is growing rapidly?

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119715474

3rd Canadian Edition

Authors: Christopher D. Burnley