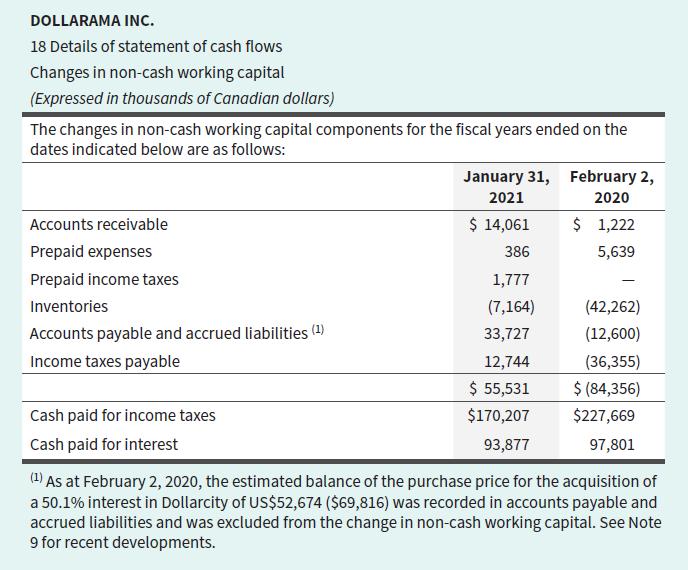

Exhibits 5.22B and show the consolidated statement of cash flows of Dollarama Inc. for the years ended

Question:

Exhibits 5.22B and show the consolidated statement of cash flows of Dollarama Inc. for the years ended January 31, 2021, and February 2, 2020, along with related note disclosure.

Required

a. How did Dollarama’s net income in 2021 compare with the cash flows from operating activities? What was the largest difference between these two amounts?

b. Did Dollarama increase or decrease the amount of inventory in its stores between 2020 and 2021? Is this consistent with the nature of the changes reflected in the company’s cash flows from investing activities?

c. What effect did the change in the company’s accounts payable and accrued liabilities have on cash flows from operating activities in 2021? What does this tell you about the balance owed to these creditors?

d. Explain why depreciation and amortization expenses amounting to $269,633 were added back to net earnings in determining Dollarama’s 2021 cash flows from operating activities.

e. Examine the financing activities section of Dollarama’s statement of cash flows and comment on the main differences between 2021 and 2020.

f. How much did Dollarama pay in dividends during 2021? How did this compare with the amount of cash the company paid to repurchase common shares that had been issued previously?

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119715474

3rd Canadian Edition

Authors: Christopher D. Burnley