Exhibits 5.20A and 5.20B show the consolidated statement of cash flows of Dollarama Inc. for the years

Question:

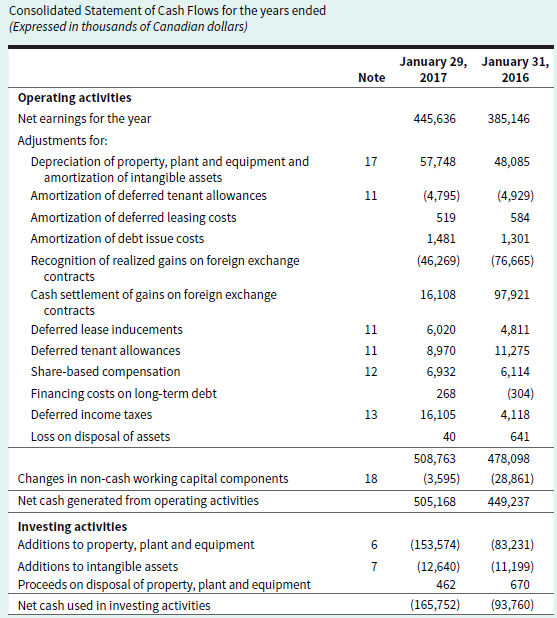

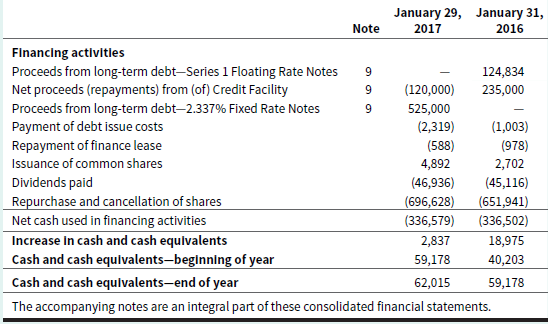

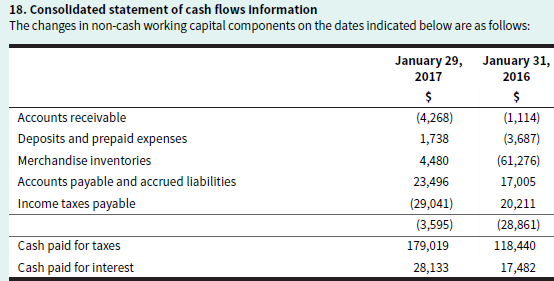

Exhibits 5.20A and 5.20B show the consolidated statement of cash flows of Dollarama Inc. for the years ended January 29, 2017, and January 31, 2016, along with related note disclosure.

EXHIBIT 5.20A Dollarama Inc.’s 2017 Consolidated Statement of Cash Flows

EXHIBIT 5.20B Excerpt from Dollarama Inc.’s 2017 Annual Report

Required

a. How did Dollarama’s net income in 2017 compare with the cash flows from operating activities? What was the largest difference between these two amounts?

b. Did Dollarama increase or decrease the amount of inventory in its stores between 2016 and 2017? Is this consistent with the nature of the changes reflected in the company’s cash flows from investing activities?

c. What effect did the change in the company’s accounts payable and accrued liabilities have on cash flows from operating activities in 2017? What does this tell you about the balance owed to these creditors?

d. Examine the financing activities section of Dollarama’s statement of cash flows and comment on the main differences between 2017 and 2016.

e. Dollarama’s total liabilities were $1,763,167 at January 29, 2017, and $1,347,022 at January 31, 2016. Calculate the company’s cash flows to total liabilities ratio and comment on whether this has improved or worsened from 2016 to 2017.

f. Calculate Dollarama’s net free cash flow and discuss the company’s ability to generate the cash required to continue to grow the company’s operations and repay its debt.

Accounts PayableAccounts payable (AP) are bills to be paid as part of the normal course of business.This is a standard accounting term, one of the most common liabilities, which normally appears in the balance sheet listing of liabilities. Businesses receive... Free Cash Flow

Free cash flow (FCF) represents the cash a company generates after accounting for cash outflows to support operations and maintain its capital assets. Unlike earnings or net income, free cash flow is a measure of profitability that excludes the...

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119406921

2nd Canadian Edition

Authors: Christopher D. Burnley