Financial statements of Waterloo Brewing Ltd. Base your answers to the following questions on the 2021 financial

Question:

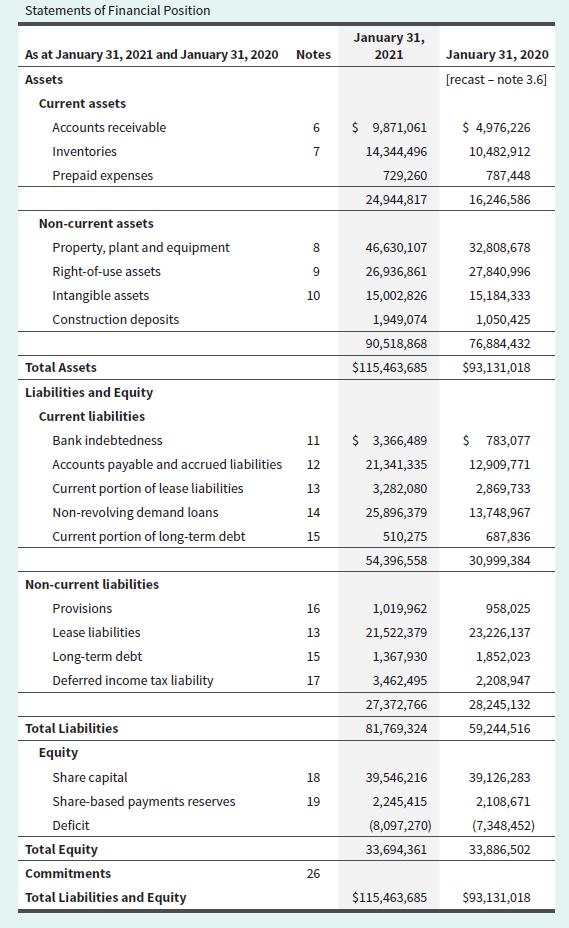

Financial statements of Waterloo Brewing Ltd. Base your answers to the following questions on the 2021 financial statements for Waterloo Brewing Ltd. in Exhibits 1.28A

In the questions below, the year 2021 refers to Waterloo Brewing’s fiscal year ended January 31, 2021, and the year 2020 refers to the prior year ended January 31, 2020.

In the questions below, the year 2021 refers to Waterloo Brewing’s fiscal year ended January 31, 2021, and the year 2020 refers to the prior year ended January 31, 2020.

Required

a. Waterloo Brewing’s financial statements do not include the word “consolidated” in their title. What does this tell you about the company’s structure?

b. Waterloo Brewing prepared a classified statement of financial position. Calculate the difference between current assets and current liabilities at the end of 2021, and at the end of 2020. This amount is referred to as working capital. Did the company’s working capital improve in 2021? Explain.

c. Find the following amounts in Waterloo Brewing’s statements:

i. Revenues in 2021

ii. Cost of sales in 2021

iii. Gross profit (as a dollar amount and as a percentage) in 2021

iv. Selling, marketing, and administration expenses in 2020

v. Income tax expense in 2020 vi. Net income in 2021

vii. Intangible assets at the end of 2021

viii. Accounts receivable at the beginning of 2021

ix. Share capital at the end of 2021

x. Property, plant, and equipment at the end of 2021

xi. Cash flows from operating activities in 2021

xii. Cash payments to purchase property, plant, and equipment in 2021

xiii. Cash used for the payment of dividends in 2021

d. Did Waterloo Brewing finance the company’s assets mainly from creditors (total liabilities) or from shareholders (shareholders’ equity) in 2021? Support your answer with appropriate calculations.

e. List the two largest sources of cash and the two largest uses of cash in 2021. (Consider cash generated from operating activities to be a single source or use of cash.)

f. Suggest some reasons why Waterloo Brewing’s net income was $3,000,013 in 2021, yet cash provided by operating activities was $12,877,105.

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119715474

3rd Canadian Edition

Authors: Christopher D. Burnley