Kayla Martchenko has just received a small inheritance from her grandparents estate. She would like to invest

Question:

Kayla Martchenko has just received a small inheritance from her grandparents’ estate. She would like to invest the money and is currently reviewing several opportunities. A friend has given her the financial statements of Robertson Furniture Ltd., a company she found on the Internet. Kayla has reviewed the financial statements and is ready to invest in Robertson Furniture.

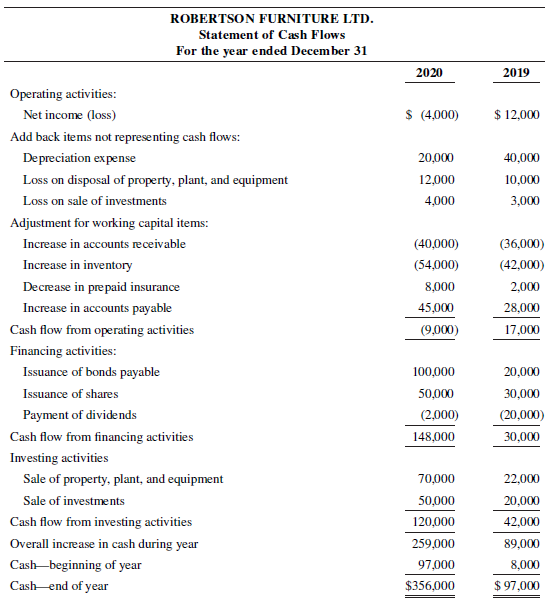

Before she invests, Kayla comes to you for some financial advice, because she knows you are taking an accounting course and may be able to give her some insights into the financial statements. She is convinced that this company will be a profitable investment because the statement of financial position indicates that the company’s cash balances have been increasing very rapidly, from only $8,000 two years ago to $354,000 now.

Kayla has copied Robertson’s statement of cash flows for you, so that you can see how much cash the company has been able to generate each year.

Required

a. Comment on Robertson Furniture’s statement of cash flows and address Kayla’s opinion that, in light of the amount of cash it has generated, the company must be a good investment.

b. Based on the results of your analysis of Robertson’s statement of cash flows, outline several points that Kayla should investigate about this company before investing her inheritance in it.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119406921

2nd Canadian Edition

Authors: Christopher D. Burnley