Quick Sweep Ltd. manufactures industrial sweepers for cleaning malls and other commercial space. All sales are on

Question:

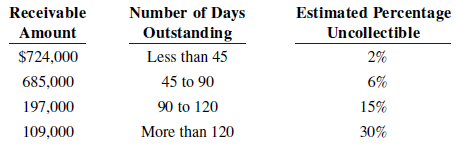

Quick Sweep Ltd. manufactures industrial sweepers for cleaning malls and other commercial space. All sales are on account, with terms n/45. During the year ending October 31, 2020, Quick Sweep recorded sales of $9,210,000. The company’s bookkeeper prepared the following aging schedule as at October 31:

The Allowance for Doubtful Accounts had a credit balance of $37,250 before the year-end adjustment was made.

Required

a. Prepare the adjusting entry to bring Allowance for Doubtful Accounts to the desired level.

b. Quick Sweep’s general manager has asked you about factoring some of the company’s receivables to free up some cash that could be used to purchase more inventory. She has approached a finance company, which has indicated that it would be willing to purchase up to $500,000 of the company’s current receivables on a without recourse basis. The finance company is willing to pay $457,500 for these receivables, which Quick Sweep would continue to service. The manager has asked you to explain what it means that they are being sold without recourse. She also wonders if there might be a way to factor the receivables for a greater payment amount.

c. What suggestions would you make regarding Quick Sweep’s management of its accounts receivable?

Aging ScheduleAging schedule is an accounting table that shows a company’s account receivables. It is an summarized presentation of accounts receivable into a separate time brackets that the rank received based upon the days due or the days past due. Generally...

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119406921

2nd Canadian Edition

Authors: Christopher D. Burnley