Question: Saskatoon- based Nutrien Ltd. is the worlds largest provider of crop inputs and services. Excerpts from its 2020 financial statements are in Exhibits 2.20A Required

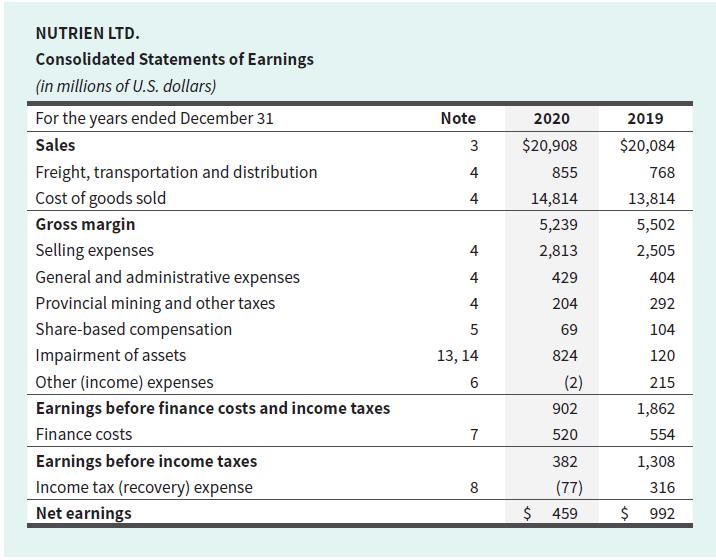

Saskatoon- based Nutrien Ltd. is the world’s largest provider of crop inputs and services. Excerpts from its 2020 financial statements are in Exhibits 2.20A

Required

Use the financial statements to answer the following questions.

a. Calculate the growth in the following accounts from December 31, 2019, to December 31, 2020:

i. Sales

ii. Cost of Goods Sold

iii. Net Earnings

iv. Total Assets

v. Total Shareholders’ Equity Would you expect each of these accounts to grow at the same rate? Why or why not? Comment on the growth rates you calculated.

b. Based on your analysis from part (a), did the equity investors finance more of the company in 2020 than they did in 2019?

c. Calculate the following ratios for each of the two years presented. (Note that, in order to be able to calculate these ratios for each of the years, you will have to use the total assets for each year and the total shareholders’ equity for each year in your ratios, rather than average total assets and average shareholders’ equity.) i. Profit margin ratio

ii. Return on assets

iii. Return on equity Comment on your results. Do the results from part (a) help you interpret the changes in these ratios? Why or why not?

NUTRIEN LTD. Consolidated Statements of Earnings (in millions of U.S. dollars) For the years ended December 31 Sales Freight, transportation and distribution Cost of goods sold Gross margin Selling expenses General and administrative expenses Provincial mining and other taxes Share-based compensation Impairment of assets Other (income) expenses Earnings before finance costs and income taxes Finance costs Earnings before income taxes Income tax (recovery) expense Net earnings Note 3 4 4 4 4 4 5 13, 14 6 7 8 2020 $20,908 855 14,814 5,239 2,813 429 204 69 824 $ (2) 902 520 382 (77) 459 2019 $20,084 768 13,814 5,502 2,505 $ 404 292 104 120 215 1,862 554 1,308 316 992

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

a Growth from fiscal year2019to 2020 We would not generally expect all of these accounts to grow at the same rate for a variety of reasons For example ... View full answer

Get step-by-step solutions from verified subject matter experts