Select a publicly traded company for analysis. Using the firms most recent 10-K Report, accessed through the

Question:

Select a publicly traded company for analysis. Using the firm’s most recent 10-K Report, accessed through the SEC EDGAR database at sec.gov or from the company’s website, analyze the firm’s Statement of Cash Flows, addressing the following questions:

What is the difference between the firm’s net income for the period and cash flow from operating activities, and what specific adjustments are made to explain the difference? How does the most recent year compare with the previous year’s report?

If any adjustments seem unusual or difficult to understand, use notes and other information in the 10-K Report to explain the adjustments; discuss the quality of the reported statement.

How is the change in the cash balance explained by cash flow from operating, financing, and investing activities for the most recent year?

What is your overall assessment of the company based on your analysis of the Statement of Cash Flows and any supplementary information you choose to use?

Netflix is a global entertainment company that licenses, acquires, and produces content, including its own original programming. With paid memberships, Netflix customers stream feature films, documentaries, television series, and mobile games through internet-connected devices. Founded in 1997, the company has more than 200 million subscribers in over 190 countries, providing services across a wide range of genres and languages.

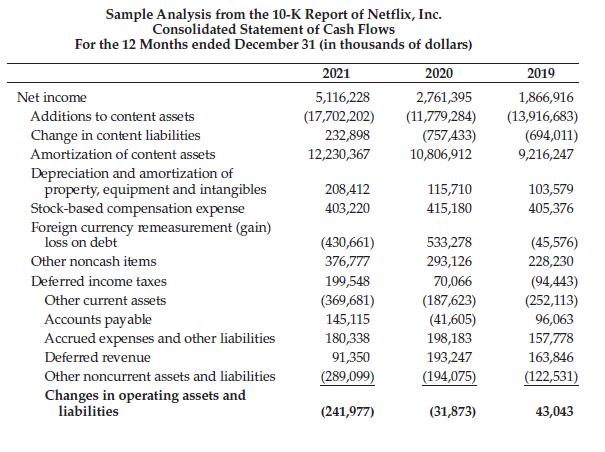

The 2021 10-K Report shows that Netflix generated \($393\) million of cash flow from operating activities in 2021 which was a significant decrease in operating cash flow relative to 2020 in spite of an 85% improvement in net income for 2021.

Netflix operating cash flow in 2021 was \($4.723\) million lower than its net income;

in contrast, the company had positive cash flows from operating activities in 2020 of \($2,427\) million, almost equal to its net income. The almost \($5\) billion difference between net income and operating cash flow is explained by the adjustments, primarily relating to content assets.

The nature of Netflix’s business as a seller of entertainment products means that unlike a company that has inventory on the shelves to sell or work-in-process inventory to manufacture products, Netflix has content assets as its inventory.

Content assets are the products such as film and television shows that Netflix has acquired for its library to offer viewers and the programs that Netflix produces itself. Although there are other adjustments to net income to calculate cash flow from operations, it is the content assets account that contributes the huge swings in cash flow, including in 2019 when cash flow from operating activities was negative \($2,887\) million in spite of a profitable year.

These content assets are amortized as a cost of revenue on the income statement, and according to notes in the Netflix 10-K Report, amortization of content assets accounts for more than half of Netflix’s cost of revenues. Netflix follows GAAP for the amortization process, using an accelerated method reflecting the fact that most of the customer viewing occurs when the products are new. The life of a content asset product according to accounting rules is no more than 10 years, with most products (90%) amortized by Netflix within 4 years after its first availability. The content assets on the balance sheet are reported net of amortization.

The adjustments to net income on the statement of cash flows reflect this accounting for content assets. In 2021, the amount for acquisitions and new product development was \($17.7\) billion, and the amount of the amortization added back as a noncash expense was \($12.2\) billion. This compares with an expenditure of \($11.8\) billion for new products in 2020 and amortization of \($10.8\) billion. That’s a significant difference in terms of amortization relative to investment, which management states is related to costs associated with delays in 2020 caused by the pandemic.

Management also states that the “Company reviews factors impacting the amortization of the content assets on an ongoing basis. The Company’s estimates related to these factors require considerable management judgment.” Management’s considerable control over the amount of amortization significantly affects its operating cash flows.

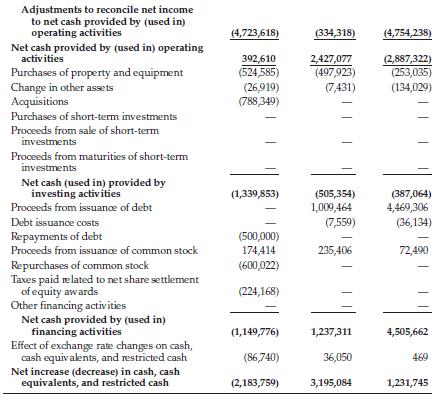

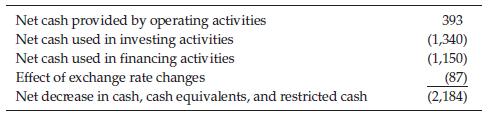

The overall change in cash for Netflix in 2021 was a decrease of \($2,184\) million.

Operating cash flow provided \($393\) million, while Netflix used \($1,340\) million for investing activities and \($1,150\) million for financing activities. The remaining difference is accounted for by the effect of exchange rate changes of \($87\) million.

From the Statement of Cash Flows for the year ended December 31, 2021 (in millions of dollars):

Netflix used cash in financing activities primarily for debt repayments and for repurchase of common stock. Investment activities consisted of property and equipment purchases and unspecified business acquisitions.

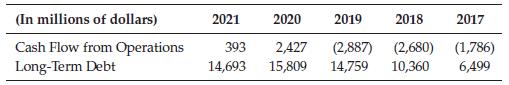

The context for Netflix current problems can be traced back at least as far as 2017, when negative cash flow from operations resulted in the company’s need to add significant amounts of long-term debt, from \($3,\) 364 million to \($6,499\) million.

Netflix continued this pattern, adding almost \($4\) billion of debt in 2018 and more than \($4\) billion in 2019, until 2020 when the company generated positive cash flows but still needed additional long-term borrowings of over \($1\) billion.

Following the release of its 2021 10-K report, a class action suit was filed against Netflix by shareholders, claiming that Netflix misled shareholders and the market by making false statements about the firm’s declining subscriber growth. Netflix had blamed the increased competition and password sharing as well as inflation and the Ukraine War for stagnant subscriber growth. On April 29, 2022, Netflix announced weaker-than-expected subscription numbers. The lawsuit claims that Netflix willfully misled investors about the nature of the company’s business operations and prospects.

The overall assessment of Netflix based on its 2021 10-K report, with a specific focus on the cash flow statement, is not promising. Operating cash flow is significantly lower than reported net income in 2021, and the net income figure is “managed” to some degree by the firm’s amortization of content assets. The shareholder lawsuit announced in early 2022 adds to this negative assessment. The impact of management’s considerable discretion in the accounting for content assets, as well as communication regarding its subscriber base, reduces the quality of the information reported in the financial statements.

In considering the outlook for Netflix, one intangible factor to consider in Netflix’s favor is the company’s unique stature in the entertainment industry. Netflix has millions of customers around the world and a respected product base. If the financial and managerial problems can be effectively addressed, Netflix will continue to have the potential for future growth and successful operations.

Step by Step Answer:

Understanding Financial Statements

ISBN: 9780138114404

12th Edition

Authors: Lyn Fraser, Aileen Ormiston