Question: Summary income statement information for Pas Corporation and its 70 percent-owned subsidiary, Sit, for the year 2012 is as follows (in thousands): REQUIRED: 1. Assume

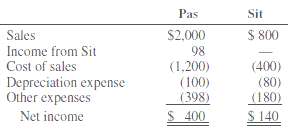

Summary income statement information for Pas Corporation and its 70 percent-owned subsidiary, Sit, for the year 2012 is as follows (in thousands):

REQUIRED:

1. Assume that Pas acquired its 70 percent interest in Sit at book value on January 1, 2011, when the fair value of Sits' assets and liabilities were equal to recorded book values. There were no intercompany transactions during 2011 and 2012. Prepare a consolidated income statement for Pas Corporation and Subsidiary for 2012.

2. Assume that Pas acquired its 70 percent interest in Sit on January 1, 2011, for $280,000. $60,000 was allocated to a reduction of overvalued equipment with a five-year remaining useful life and the remainder was allocated to goodwill. Sit's book value was $320,000. There were no intercompany transactions during 2011 and 2012. Prepare a consolidated income statement for Pas Corporation and Subsidiary for2012.

Pas Sit $ 800 Sales $2,000 Income from Sit Cost of sales Depreciation expense Other expenses 98 (1,200) (100) (398) (400) (80) (180) $ 400 S 140 Net income

Step by Step Solution

3.19 Rating (166 Votes )

There are 3 Steps involved in it

1 Pas Corporation and Subsidiary Consolidated Income Statement for the year 2012 in thou... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

55-B-A-F-S (382).docx

120 KBs Word File