Question: Suppose that the standard deviation of returns from a typical share is about .40 (or 40 percent) a year. The correlation between the returns of

Suppose that the standard deviation of returns from a typical share is about .40 (or 40 percent) a year. The correlation between the returns of each pair of shares is about .3.

a. Calculate the variance and standard deviation of the returns on a portfolio that has equal investments in two shares, three shares, and so on, up to 10 shares.

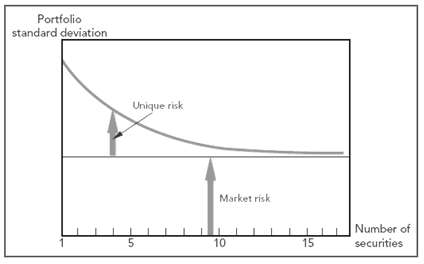

b. Use your estimates to draw a graph like Figure 7.8. How large is the underlying market risk that cannot be diversified away?

c. Now repeat the problem, assuming that the correlation between each pair of stocks iszero.

Portfolio standard deviation Unique risk Market risk Number of securities 5. 10 15

Step by Step Solution

3.38 Rating (164 Votes )

There are 3 Steps involved in it

a Refer to Figure in the text For each different portfolio the relative weight of each share is one ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

35-B-C-F-R-A-R (115).docx

120 KBs Word File