Teasdale Inc. manufactures and sells commercial and residential security equipment. The comparative unclassified balance sheets for December

Question:

Teasdale Inc. manufactures and sells commercial and residential security equipment. The comparative unclassified balance sheets for December 31, 2017 and 2016 are provided below. Selected missing balances are shown by letters.

-1.png)

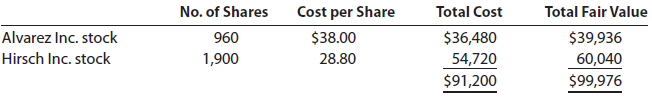

Note 1. Investments are classified as available for sale. The investments at cost and fair value on December 31, 2016, are as follows:

Note 2. The Investment in Wright Co. stock is an equity method investment representing 30% of the outstanding shares of Wright Co.

The following selected investment transactions occurred during 2017:

Mar. 18. Purchased 800 shares of Richter Inc. at $40 including brokerage commission.

Richter is classified as an available-for-sale security.

July 12. Dividends of $12,000 are received on the Wright Co. investment.

Oct. 1. Purchased $24,000 of Toon Co. 4%, 10-year bonds at 100. The bonds are classified as available for sale. The bonds pay interest on October 1 and April 1.

Dec. 31. Wright Co. reported a total net income of $80,000 for 2017. Teasdale recorded equity earnings for its share of Wright Co. net income.

31. Accrued interest for three months on the Toon Co. bonds purchased on October 1.

31. Adjusted the available-for-sale investment portfolio to fair value, using the following fair value per-share amounts:

Available-for-Sale

Investments____________________ Fair Value

Alvarez Inc. stock........................$41.50 per share

Hirsch Inc. stock..........................$26.00 per share

Richter Inc. stock.........................$48.00 per share

Toon Co. bonds...........................101 per $100 of face amount

31. Closed the Teasdale Inc. net income of $51,240. Teasdale Inc. paid no dividends during the year.

Instructions

Determine the missing letters in the unclassified balance sheet. Provide appropriate supporting calculations.

A portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Step by Step Answer:

Financial Accounting

ISBN: 978-1305088436

14th edition

Authors: Carl S. Warren, Jim Reeve, Jonathan Duchac