Go back

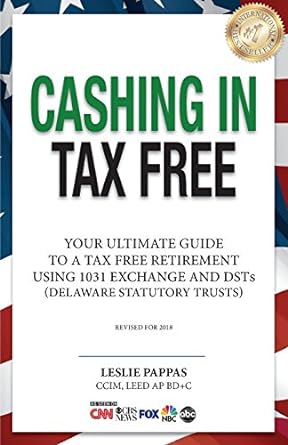

Cashing In Tax Free Your Ultimate Guide To A Tax Free Retirement Using 1031 Exchange And Delaware Statutory Trusts Revised For 2021(2021st Edition)

Authors:

Leslie Pappas

Cover Type:Hardcover

Condition:Used

In Stock

Include with your book

Free shipping: April 03, 2024Popular items with books

Access to 3 Million+ solutions

Free ✝

Ask 10 Questions from expert

200,000+ Expert answers

✝ 7 days-trial

Total Price:

$0

List Price: $15.99

Savings: $15.99(100%)

Book details

ISBN: 0692582142, 978-0692582145

Book publisher: Four Dogs LLLP

Get your hands on the best-selling book Cashing In Tax Free Your Ultimate Guide To A Tax Free Retirement Using 1031 Exchange And Delaware Statutory Trusts Revised For 2021 2021st Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.

Cashing In Tax Free Your Ultimate Guide To A Tax Free Retirement Using 1031 Exchange And Delaware Statutory Trusts Revised For 2021 2021st Edition Summary: Revised for 2021, This book outlines the benefits, process, and must-knows of institutional investments. Professional asset and property managers, experienced and proven experts, select, purchase, upgrade and operate Delaware Statutory Trusts to maximize cash flow and long-term returns. Their firms have been producing average annual returns in the range of 10-13 percent and higher. This book will show you how the industry works, will help you determine if it's a good fit, and guide you in choosing professional advisors - not everyone holding a securities license is not created equal. The book also lets you peek into the lives and portfolios of real clients as they use this strategy to boost their own investments.The book also details more sophisticated uses of institutional investing like Sequential 1031 Exchanges, maximizing depreciation and long-term estate planning concepts. It's a can't miss for any serious real estate investor.

Customers also bought these books

Frequently Bought Together

Top Reviews for Books

Keith lebanowski

( 5 )

"Delivery was considerably fast, and the book I received was in a good condition."