Go back

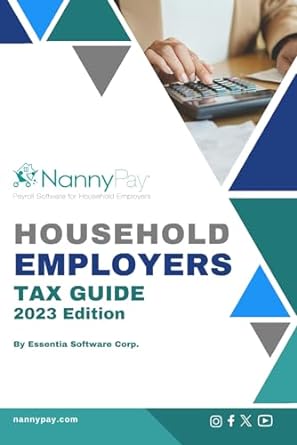

Household Employers Tax Guide(2023 Edition)

Authors:

Essentia Software Corporation

Cover Type:Hardcover

Condition:Used

In Stock

Include with your book

Free shipping: April 03, 2024Popular items with books

Access to 3 Million+ solutions

Free ✝

Ask 10 Questions from expert

200,000+ Expert answers

✝ 7 days-trial

Total Price:

$0

List Price: $24.99

Savings: $24.99(100%)

Book details

ISBN: 979-8864694466

Book publisher: Independently published

Get your hands on the best-selling book Household Employers Tax Guide 2023 Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.

Household Employers Tax Guide 2023 Edition Summary: This guide is designed for first-time household employer's.It covers the six steps necessary to becoming a household employer and how to pay both your employee and employer taxes.This guide includes a $25 discount on the first year of NannyPay DIY household payroll software, available at nannypay.com. The software is NOT required to become a household employer nor is it required to benefit from this guide.In 1997, Robert Dougher, the proud father of two young daughters, was looking for a simple payroll application that would permit him to calculate withholding taxes for his nanny's payroll check. Hiring a payroll service was an unnecessary and costly expense. Other than complicated integrated accounting software, there was nothing to be found. Believing that there were other household employers in the same situation, Robert teamed up with Adam Garson, founded Essentia Software Corporation, and wrote the first version of NannyPay payroll software for household employers. Necessity was truly the mother of invention.That was 26 years ago and since then NannyPay software has developed into the primary software tool for do-it-yourself household payroll. Over the years, Robert and Adam have learned a lot about the tax rules and regulations governing household employment and would like all household employers to benefit from this education, even if they do not use NannyPay software. That is the genesis of this brief Employer's Guide.

Customers also bought these books

Frequently Bought Together

Top Reviews for Books

ZAHWA DAWOOD SADOU

( 5 )

"Delivery was considerably fast, and the book I received was in a good condition."