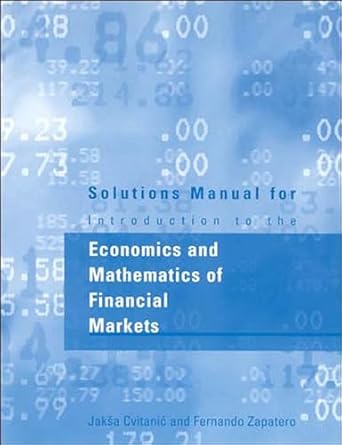

Introduction To The Economics Of Financial Markets(1st Edition)

Authors:

James Bradfield

Type:Hardcover/ PaperBack / Loose Leaf

Condition: Used/New

In Stock: 1 Left

Shipment time

Expected shipping within 2 - 3 DaysPopular items with books

Access to 35 Million+ Textbooks solutions

Free ✝

Ask Unlimited Questions from expert

AI-Powered Answers

30 Min Free Tutoring Session

✝ 7 days-trial

Total Price:

$0

List Price: $9.00

Savings: $9

(100%)

Solution Manual Includes

Access to 30 Million+ solutions

Ask 50 Questions from expert

AI-Powered Answers

24/7 Tutor Help

Detailed solutions for Introduction To The Economics Of Financial Markets

Price:

$9.99

/month

Book details

ISBN: 0195310632, 9780195310634

Book publisher: Oxford University Press

Offer Just for You!:

Buy 2 books before the end of January and enter our lucky draw.