Question: The affiliation structure for a group of interrelated companies is diagrammed as follows: The investments were acquired at fair value equal to book value in

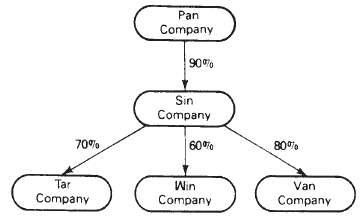

The affiliation structure for a group of interrelated companies is diagrammed as follows:

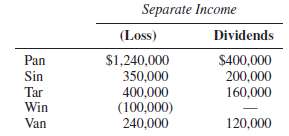

The investments were acquired at fair value equal to book value in 2011, and there are no unrealized or constructive profits or losses.Separate incomes and dividends for the companies for 2011 are:

1. The noncontrolling interest share of Tar Company's net income for 2011 is:(a) $120,000(b) $148,000(c) $252,000(d) $280,0002. The noncontrolling interest share of Van Company's net income for 2011 is:(a) $48,000(b) $96,000(c) $110,400(d) $144,0003. The total noncontrolling interest share that should appear in the consolidated income statement for 2011 is:(a) $244,200(b) $210,200(c) $204,200(d) $76,2004. Controlling share of consolidated net income for Pan Company and Subsidiaries for 2011 is:(a) $1,925,800(b) $1,881,800(c) $1,240,000(d) $685,8005. Pan's Investment in Sin account should reflect a net increase for 2011 in the amount of:(a) $762,000(b) $685,800(c) $625,800(d) $505,800

Pan Company 90% Sin Company 70% 60% 800% Tar Win Van Company Company Company

Step by Step Solution

3.26 Rating (164 Votes )

There are 3 Steps involved in it

1 b Separate income of Tar 400000 Included in consolidated net income 9 7 400000 252000 148000 Alter... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

55-B-A-I-M-H (20).docx

120 KBs Word File