The cash account of Delta, Inc., disclosed a balance of $17,056.48 on October 31.The bank statement as

Question:

The cash account of Delta, Inc., disclosed a balance of $17,056.48 on October 31.The bank statement as of October 31 showed a balance of $21,209.45. Upon comparing the statement with the cash records, the following facts were developed.

(a) Delta’s account was charged on October 26 for a customer’s uncollectible check amounting to $1,143.

(b) A 2-month, 9%, $3,000 customer’s note dated August 25, discounted on October 12, was dishonored October 26 and the bank charged Delta $3,050.83, which included a protest fee of $5.83.

(c) A customer’s check for $725 was entered as $625 by both the depositor and the bank but was later corrected by the bank.

(d) Check No. 661 for $1,242.50 was entered in the cash disbursements journal at $1,224.50 and check No. 652 for $32.90 was entered as $329.00. The company uses the voucher system.

(e) Bank service charges of $39.43 for October were not yet recorded on the books.

(f) A bank memo stated that M. Sears’ note for $2,500 and interest of $62.50 had been collected on October 29, and the bank charged $12.50. (No entry was made on the books when the note was sent to the bank for collection.)

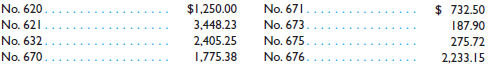

(g) Receipts of October 29 for $6,850 were deposited November 1. The following checks were outstanding on October 31:

Instructions:

1. Prepare a bank reconciliation as of October 31.

2. Give the journal entries required as a result of the preceding information.

Step by Step Answer:

Intermediate Accounting

ISBN: 978-0324312140

16th Edition

Authors: James D. Stice, Earl K. Stice, Fred Skousen