Question: The DuPont formula defines the net return on shareholders equity as a function of the following components: Operating margin Asset turnover Interest

The DuPont formula defines the net return on shareholders’ equity as a function of the following components:

• Operating margin

• Asset turnover

• Interest burden

• Financial leverage

• Income tax rate

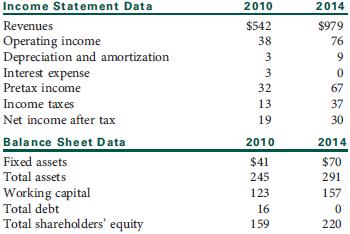

Using only the data in the table shown below:

a. Calculate each of the five components listed above for 2010 and 2014, and calculate the return on equity (ROE) for 2010 and 2014, using all of the five components. Show calculations.

b. Briefly discuss the impact of the changes in asset turnover and financial leverage on the change in ROE from 2010 to 2014.

Income Statement Data Revenues Operating income Depreciation and amortization Interest expense Pretax income Income taxes Net income after tax 2010 $542 38 2014 $979 76 32 13 67 37 30 Balance Sheet Data 2010 $41 245 123 16 159 2014 $70 291 157 Fixed assets Total assets Working capital Total debt Total shareholders equity 220

Step by Step Solution

3.32 Rating (161 Votes )

There are 3 Steps involved in it

2010 2014 a To clarify a point of possible confusion operating income in the problem setup excludes ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

370-B-A-I (4438).docx

120 KBs Word File