The following information was taken from the footnotes to Johnson & Johnson's 2008 financial statements (dollars in

Question:

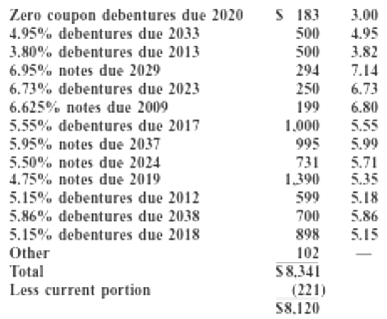

The following information was taken from the footnotes to Johnson & Johnson's 2008 financial statements (dollars in millions):

Required:

(a) Which amounts appeared on Johnson & Johnson's balance sheet and where?

(b) What is a zero coupon debenture, and how does the effective interest rate affect the debenture? Explain.

(c) Which of the long-term debts above were issued at face value (i.e., sold at par)?

(d) Is the face value of the 6.95 percent notes due 2029 greater than, less than, or equal to the balance sheet value? Explain.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Face Value

Face value is a financial term used to describe the nominal or dollar value of a security, as stated by its issuer. For stocks, the face value is the original cost of the stock, as listed on the certificate. For bonds, it is the amount paid to the...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: