Question: The following table repeats the annual total returns on the MSCI Germany Index previously given (see CFA Question 6-2) and also gives the annual total

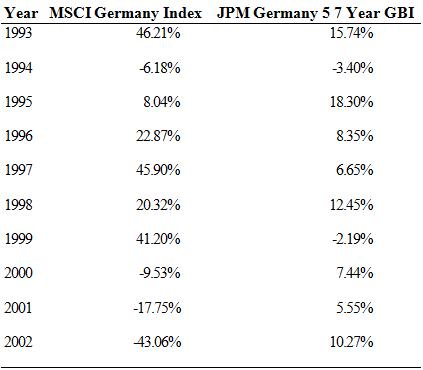

The following table repeats the annual total returns on the MSCI Germany Index previously given (see CFA Question 6-2) and also gives the annual total returns on the JP Morgan Germany 5- to 7-year government bond index (JPM 5—7 Year GBI, for short). During the period given in the table, the International Monetary Fund Ger-many Money Market Index (IMF Germany MMI, for short) had a mean total return of 4.33 percent. Use that information and the information in the table to answer Problems A through C.

a. Calculate the annual returns and the mean annual return on a portfolio 60 percent invested in the MSCI Germany Index and 40 percent invested in the JPM Germany GBI.

b. Using the IMF Germany MMI as a proxy for the risk-free return, calculate the Sharpe ratio for

i. The 60/40 equity/bond portfolio described in Problem A.

ii. The MSCI Germany Index.

iii. The JPM Germany five—seven year GBI.

Year MSCI Germanv Index JPM Germanv 5 7 Year GBI 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 46.21% 6.18% 8.04% 22.87% 45.90% 20.32% 41.20% -953% 17.75% 43.06% 15.74% 3.40% 18.30% 8.35% 6.65% 12.45% 2.19% 7.44% 5.55% 10.27%

Step by Step Solution

3.32 Rating (158 Votes )

There are 3 Steps involved in it

A The following table shows the calculation of the portfolios annual returns and the mean annual ret... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

650-B-A-I (7683).docx

120 KBs Word File