The long rate R and the short rate r are known to have a jointly normal distribution

Question:

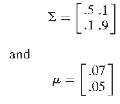

The long rate R and the short rate r are known to have a jointly normal distribution with variance-covariance matrix ? and mean ?. These moments are given by

Let the corresponding joint density be denoted by f (R,r).

(a) Using Mathematica or Maple plot this joint density.

(b) Find a function ?(R,r) such that the interest rates have zero mean under the probability:

dp =??(R,r)f(R,r)dRdr.

(c) Plot ?(R,r) and the new density.

(d) Has the variance-covariance matrix of interest rate vector changed?

DistributionThe word "distribution" has several meanings in the financial world, most of them pertaining to the payment of assets from a fund, account, or individual security to an investor or beneficiary. Retirement account distributions are among the most...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

An Introduction to the Mathematics of financial Derivatives

ISBN: 978-0123846822

2nd Edition

Authors: Salih N. Neftci

Question Posted: