The net income and working capital accounts lot two companies in the same industry, ABC Company and

Question:

The net income and working capital accounts lot two companies in the same industry, ABC Company and XYZ Company, follow:

ABC XYZ

1/1-12/31 Net income$10,000$24,000

12/31 Working capital 16,000 30,000

After reviewing the complete financial statements of the t companies, you note that ABC and XYZ use different inventory valuation and depreciation methods. ABC uses method A to value its inventory, while XYZ uses method B. Had ABC used B and XYZ used A, their ini1tory accounts would have been $10.000 greater and $10.000 smaller, respectively. Similarly, ABC uses method X depreciation, while XYZ uses method Y. Had XYZ used X and ABC used Y, their depreciation expenses for the year would have been $8,000 higher and $8,000 lower, respectively.

REQUIRED:

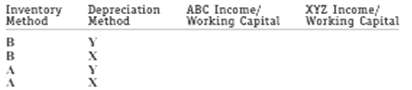

a. Calculate net income and working capital for the two companies under the following assumptions.

b. Given this information, which combination of inventory and depreciation methods gives rise k the highest income and working capital numbers? Can you think of reasons why a manager would choose one method or over another? Would managers always choose the method that result in the highest income? Why or why not?c. If you were an investor attempting to decide in which company to invest, how would you treat the fact that the two companies used different methods to account for inventory and fixed assets? Is there a principle of accounting that covers this situation? Why or whynot?

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer: