Question: The notes to the Wolfe Ltd. fnancial statements reported the following data on December 31, Year 1 (end of the fscal year): Wolfe Ltd. amortizes

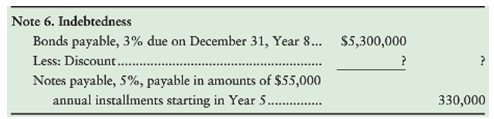

The notes to the Wolfe Ltd. fnancial statements reported the following data on December 31, Year 1 (end of the fscal year):

Wolfe Ltd. amortizes bond discount by the effective-interest method and pays all interest amounts at December 31.

Requirements

1. Assume the market interest rate on January 1 of year 1, the date of issuance of the bonds, is 4%. Answer the following questions about Wolfe Ltd.’s long-term liabilities:

a. Using the PV function in Excel, what is the issue price of the bonds?

b. What is the maturity value of the 3% bonds?

c. What is Wolfe Ltd.’s annual cash interest payment on the 3% bonds?

d. What is the carrying amount of the 3% bonds at December 31, year 1?

2. Using Figure 9-4 as a model, prepare an amortization table through the maturity date for the 3% bonds. (Round all amounts to the nearest dollar.) How much is Wolfe Ltd.’s interest expense on the 3% bonds for the year ended December 31, Year 4?

3. Show how Wolfe Ltd. would report the 3% bonds payable and the 5% notes payable at December 31, Year 4.

Note 6. Indebtedness Bonds payable, 3% due on December 31, Year 8... Less: Discount.. Notes payable, 5%, payable in amounts of $55,000 annual installments starting in Year 5 . $5,300,000 330,000

Step by Step Solution

3.34 Rating (166 Votes )

There are 3 Steps involved in it

Req 1 a Using the PV function in EXCEL the issue price of the bonds is 4943165 b Maturity value is 5... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

316-B-A-L (4108).docx

120 KBs Word File