Question: The Robinson Company from Problem 2 had net sales of $1,200,000 in 2010 and $1,300,000 in 2011. The Robinson Company had the following current assets

The Robinson Company from Problem 2 had net sales of $1,200,000 in 2010 and $1,300,000 in 2011.

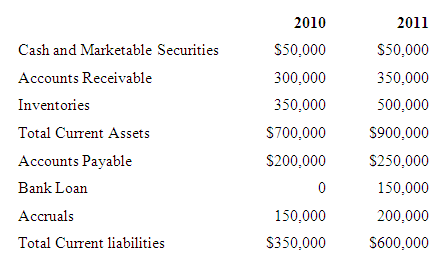

The Robinson Company had the following current assets and current liabilities for these two years: If sales in 2010 were $1.2 million, sales in 2011 were $1.3 million, and cost of goods sold was 70 percent of sales, how long were Robinson’s

a. Determine the receivables turnover in each year.

2010 2011

AR turnover

b. Calculate the average collection period for each year.

2010 2011

Average collection period

c. Based on the receivables turnover for 2010, estimate the investment in receivables if net sales were $1,300,000 in 2011.

Receivables investment

d. How much of a change in the 2011 receivables occurred?

Expected change in AR

Actual change in AR

2010 2011 Cash and Marketable Securities S50,000 S50,000 Accounts Receivable 300,000 350,000 350,000 Inventories 500,000 $900,000 Total Current Assets S700,000 Accounts Payable S200,000 S250,000 Bank Loan 150,000 Accruals 150,000 200,000 S350,000 Total Current liabilities S600,000

Step by Step Solution

3.38 Rating (157 Votes )

There are 3 Steps involved in it

A B For 2010 Average collection period 3654 9125 Days For 2011 Average Coll... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

68-B-A-A-C (2166).docx

120 KBs Word File