Question: The separate incomes (which do not include investment income) of Pic Corporation and Sil Corporation, its 80 percentowned subsidiary, for 2011 were determined as follows

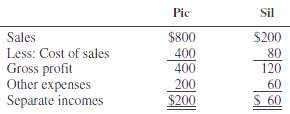

The separate incomes (which do not include investment income) of Pic Corporation and Sil Corporation, its 80 percentowned subsidiary, for 2011 were determined as follows (in thousands):

During 2011, Pic sold merchandise that cost $40,000 to Sil for $80,000, and at December 31, 2011, half of these inventory items remained unsold by Sil.REQUIRED: Prepare a consolidated income statement for Pic Corporation and Subsidiary for the year ended December 31,2011.

Pic Sil Sales Less: Cost of sales Gross profit Other expenses Separate incomes $800 400 400 $200 80 120 60 200 $ 60 $200

Step by Step Solution

3.38 Rating (167 Votes )

There are 3 Steps involved in it

Pic Corporation and Subsidiary Consolidated Income Statement for the year ended De... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

55-B-A-T-D (230).docx

120 KBs Word File