Question: The Vang Hotel opened for business on May 1, 2012. Here is its trial balance before adjustment on May 31. Other data:1. Insurance expires at

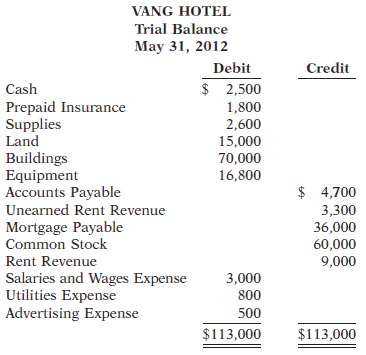

The Vang Hotel opened for business on May 1, 2012. Here is its trial balance before adjustment on May 31.

Other data:1. Insurance expires at the rate of $450 per month.2. A count of supplies shows $1,050 of unused supplies on May 31.3. Annual depreciation is $3,600 on the building and $3,000 on equipment.4. The mortgage interest rate is 6%. (The mortgage was taken out on May 1.)5. Unearned rent of $2,500 has been earned.6. Salaries of $900 are accrued and unpaid at May 31.Instructions(a) Journalize the adjusting entries on May 31.(b) Prepare a ledger using T accounts. Enter the trial balance amounts and post the adjusting entries.(c) Prepare an adjusted trial balance on May 31.(d) Prepare an income statement and a retained earnings statement for the month of May and a classified balance sheet at May 31.(e) Identify which accounts should be closed on May31.

VANG HOTEL Trial Balance May 31, 2012 Debit Credit $ 2,500 Cash Prepaid Insurance Supplies Land 1,800 2,600 15,000 Buildings Equipment Accounts Payable Unearned Rent Revenue 70,000 16,800 $ 4,700 3,300 36,000 Mortgage Payable Common Stock 60,000 9,000 Rent Revenue Salaries and Wages Expense Utilities Expense Advertising Expense 3,000 800 500 $113,000 $113,000

Step by Step Solution

3.54 Rating (168 Votes )

There are 3 Steps involved in it

a 1 May 31 Insurance Expense 450 Prepaid Insurance 450 2 31 Supplies Expense 1550 Supplies 2600 1050 1550 3 31 Depreciation Expense 3600 X 112 300 Accumulated Depreciation x Building 300 31 Depreciati... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

48-B-A-F-A (62).docx

120 KBs Word File