Question: Rolling Hills Golf Inc. was organized on July 1, 2012. Quarterly financial statements are prepared. The trial balance and adjusted trial balance on September 30

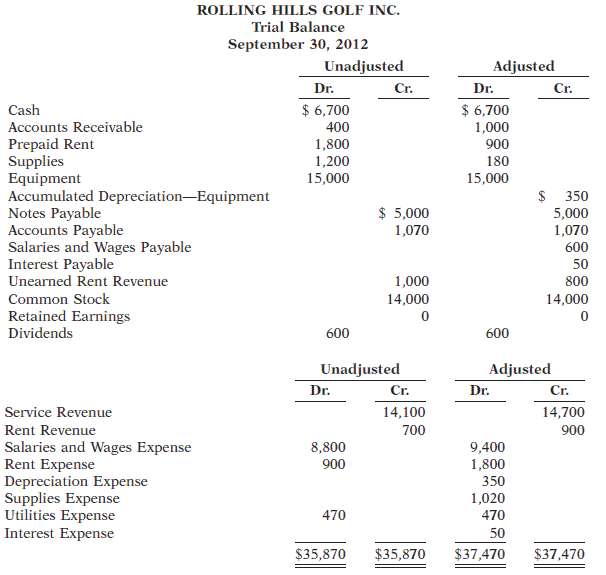

Rolling Hills Golf Inc. was organized on July 1, 2012. Quarterly financial statements are prepared. The trial balance and adjusted trial balance on September 30 are shown here.

Instructions(a) Journalize the adjusting entries that were made.(b) Prepare an income statement and a retained earnings statement for the 3 months ending September 30 and a classified balance sheet at September 30.(c) Identify which accounts should be closed on September 30.(d) If the note bears interest at 12%, how many months has it beenoutstanding?

ROLLING HILLS GOLF INC. Trial Balance September 30, 2012 Unadjusted Cr. Adjusted Cr. Dr. Dr. $ 6,700 $ 6,700 1,000 900 Cash Accounts Receivable Prepaid Rent Supplies Equipment Accumulated Depreciation-Equipment Notes Payable Accounts Payable Salaries and Wages Payable Interest Payable Unearned Rent Revenue 400 1,800 1,200 15,000 180 15,000 $ 350 5,000 1,070 $ 5,000 1,070 600 50 1,000 800 Common Stock 14,000 14,000 Retained Earnings Dividends 600 600 Unadjusted Cr. Adjusted Cr. Dr. Dr. Service Revenue 14,100 14,700 Rent Revenue 700 900 Salaries and Wages Expense Rent Expense Depreciation Expense Supplies Expense Utilities Expense Interest Expense 8,800 9,400 1,800 350 900 1,020 470 470 50 $35,870 $35,870 $37,470 $37,470

Step by Step Solution

3.41 Rating (167 Votes )

There are 3 Steps involved in it

a Sept 30 Accounts Receivable 600 Service Revenue 600 30 Rent Expense 900 Prepaid Rent 900 30 Supplies Expense 1020 Supplies 1020 30 Depreciation Expe... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

48-B-A-F-A (63).docx

120 KBs Word File