Question: To develop an example that can be presented to CD?s management as an illustration, consider two hypothetical firms, Firm U, with zero debt financing and

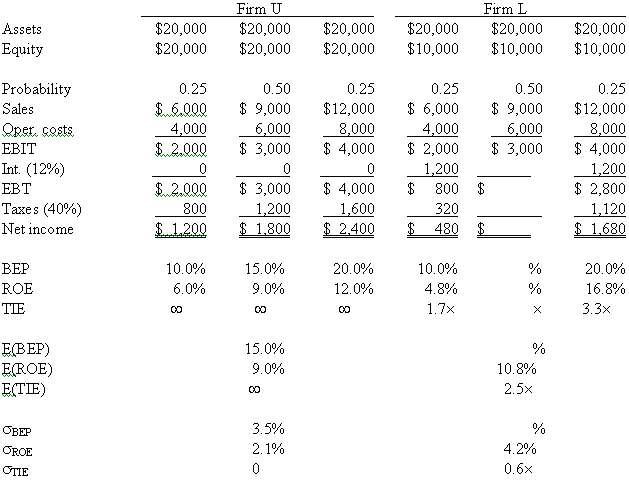

To develop an example that can be presented to CD?s management as an illustration, consider two hypothetical firms, Firm U, with zero debt financing and Firm L, with $10,000 of 12% debt. Both firms have $20,000 in total assets and a 40% federal-plus-state tax rate, and they have the following EBIT probability distribution for next year:

Firm U $20,000 $20,000 Firm L $20,000 $10,000 $20,000 $20,000 $20,000 $20,000 $20,000 $10,000 $20,000 $10,000 Assets Equity 0.25 Probability 0.25 0.50 0.25 0.25 0.50 $ 6,000 4,000 $ 2,000 $ 9,000 $ 9,000 6,000 $ 3,000 $.6.000 4,000 $.2.000 $12,000 8,000 $ 4,000 $12,000 8,000 $ 4,000 1,200 $ 2,800 1,120 $ 1.680 Sales Oper. costs 6,000 $ 3,000 EBIT Int. (12%) 1,200 $ 800 $ $ 3,000 $ 4,000 $ 2.000 EBT Taxes (40%) 1,600 $ 2.400 800 1,200 $ 1.800 320 $ 480 $ Net income S1.200 BEP 10.0% 15.0% 20.0% 10.0% 20.0% 16.8% ROE 6.0% 9.0% 12.0% 4.8% 1.7x TIE 3.3x 15.0% EBEP) EROE) ECTIE) 9.0% 10.8% 2.5x 3.5% OBEP 2. 1% 4.2% OROE 0.6x OTIE

Step by Step Solution

3.30 Rating (153 Votes )

There are 3 Steps involved in it

Here are the fully completed statements Assets Equity Probability EBIT Int 12 EBT Taxes 40 Net in... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

43-B-C-F-C-S (89).docx

120 KBs Word File