Question: Transferred-in costs, weighted-average and FIFO methods. Frito-Lay, Inc., manufactures convenience foods, including potato chips and corn chips. Production of corn chips occurs in four departments:

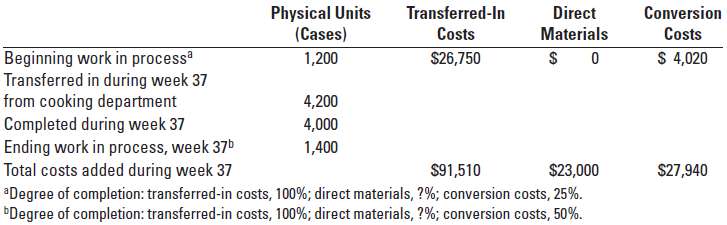

Transferred-in costs, weighted-average and FIFO methods. Frito-Lay, Inc., manufactures convenience foods, including potato chips and corn chips. Production of corn chips occurs in four departments: cleaning, mixing, cooking, and drying and packaging. Consider the drying and packaging department, where direct materials (packaging) are added at the end of the process. Conversion costs are added evenly during the process. The accounting records of a Frito-Lay plant provide the following information for corn chips in its drying and packaging department during a weekly period (week 37):

Required1. Using the weighted-average method, summarize the total drying and packaging department costs for week 37, and assign total costs to units completed (and transferred out) and to units in ending work in process.2. Assume that the FIFO method is used for the drying and packaging department. Under FIFO, the transferred-in costs for work-in-process beginning inventory in week 37 are $28,920 (instead of $26,750 under the weighted-average method), and the transferred-in costs during week 37 from the cooking department are $93,660 (instead of $91,510 under the weighted-average method). All other data are unchanged. Summarize the total drying and packaging department costs for week 37, and assign total costs to units completed and transferred out and to units in ending work in process using the FIFOmethod.

Physical Units (Cases) 1,200 Direct Materials Conversion Transferred-In Costs Costs Beginning work in process Transferred in during week 37 from cooking department Completed during week 37 Ending work in process, week 37 Total costs added during week 37 Degree of completion: transferred-in costs, 100%; direct materials, ?%; conversion costs, 25%. Degree of completion: transferred-in costs, 100%; direct materials, ?%; conversion costs, 50%. $ 4,020 $26,750 4,200 4,000 1,400 $27,940 $23,000 $91,510

Step by Step Solution

3.41 Rating (176 Votes )

There are 3 Steps involved in it

Transferredin costs weightedaverage and FIFO methods 1 Solution Exhibit 1740A computes the equivalent units of work done to date in the Drying and Packaging Department for transferredin costs direct m... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

58-B-C-A-C-P-A (427).docx

120 KBs Word File