Question: A firm estimates that its annual sales will be $196,000 and its variable costs will be 65% of sales. These cash flows are expected

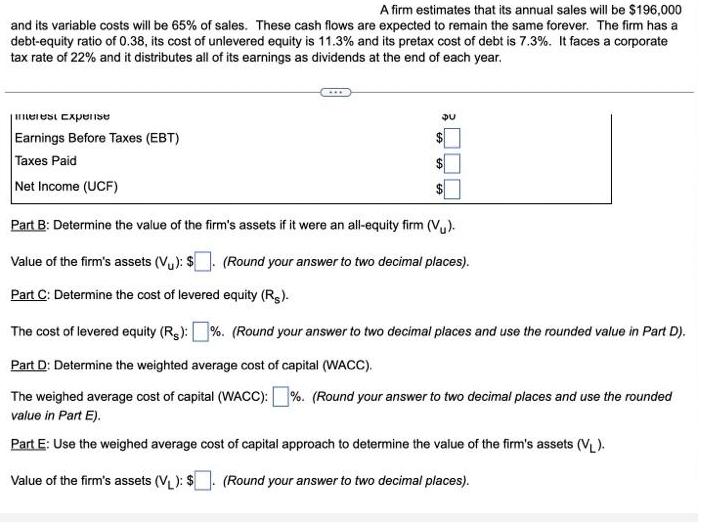

A firm estimates that its annual sales will be $196,000 and its variable costs will be 65% of sales. These cash flows are expected to remain the same forever. The firm has a debt-equity ratio of 0.38, its cost of unlevered equity is 11.3% and its pretax cost of debt is 7.3%. It faces a corporate tax rate of 22% and it distributes all of its earnings as dividends at the end of each year. interest Expense Earnings Before Taxes (EBT) Taxes Paid Net Income (UCF) Part B: Determine the value of the firm's assets if it were an all-equity firm (Vu). Value of the firm's assets (V): $ (Round your answer to two decimal places). Part C: Determine the cost of levered equity (R). DU The cost of levered equity (R$):%. (Round your answer to two decimal places and use the rounded value in Part D). Part D: Determine the weighted average cost of capital (WACC). The weighed average cost of capital (WACC):%. (Round your answer to two decimal places and use the rounded value in Part E). Part E: Use the weighed average cost of capi

Step by Step Solution

3.40 Rating (144 Votes )

There are 3 Steps involved in it

Earnings before tax EBT Sales Variable costs Interest expense 196000 065196000 0 6860... View full answer

Get step-by-step solutions from verified subject matter experts