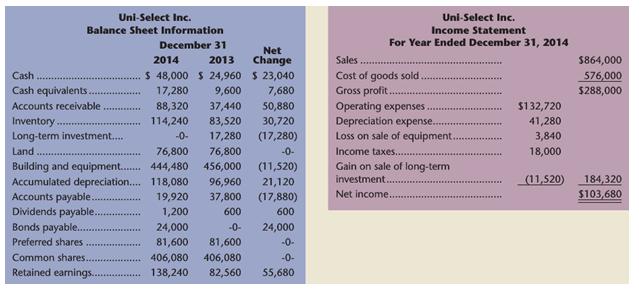

Question: Uni-Select Inc.s comparative balance sheet information at December 31, 2014 and 2013, and its income statement for the year ended December 31, 2014, are as

Uni-Select Inc.’s comparative balance sheet information at December 31, 2014 and 2013, and its income statement for the year ended December 31, 2014, are as follows:

During 2014, the following transactions occurred:

1. Purchased equipment for $19,200 cash.

2. Sold the long-term investment on January 1, 2014, for $28,800.

3. Sold equipment for $6,720 cash that had originally cost $30,720 and had $20,160 of accumulated depreciation.

4. Issued $24,000 of bonds payable at face value.

Required

1. How much cash was paid in dividends?

2. Prepare a statement of cash flows for Uni-Select for the year ended December 31, 2014, using the indirect method.

Analysis Component: The net increase in cash during 2014 for Uni-Select. was $30,720 Briefly explain what caused this change using the statement of cash flows prepared in part 2above.

Uni-Select Inc. Uni-Select Inc. Balance Sheet Information Income Statement December 31 For Year Ended December 31, 2014 Net 2014 2013 Change Sales $864,000 $ 48,000 $ 24,960 $ 23,040 9,600 Cost of goods sold. Gross profit. Cash Cash equivalents. 576,000 $288,000 17,280 88,320 114,240 7,680 37,440 83,520 Operating expenses Depreciation expense.. Loss on sale of equipment. Accounts receivable 50,880 $132,720 30,720 Inventory. Long-term investment. 41,280 3,840 -0- 17,280 (17,280) Land 76,800 444,480 76,800 456,000 96,960 -0- Income taxes.... 18,000 Building and equipment. Accumulated depreciation.. 118,080 Accounts payable. Dividends payable. Bonds payable. (11,520) Gain on sale of long-term investment.. 184,320 $103,680 21,120 (11,520) 19,920 37,800 (17,880) Net income.. 1,200 600 600 24,000 -0- 24,000 Preferred shares 81,600 81,600 -0- Common shares.. 406,080 138,240 406,080 82,560 -0- Retained earmings..... 55,680

Step by Step Solution

3.28 Rating (166 Votes )

There are 3 Steps involved in it

Part 1 Cash dividends DECLARED 48000 Net income of 103680 less 55680 change in retained earnings But ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

384-B-A-B-S-C-F (1179).docx

120 KBs Word File