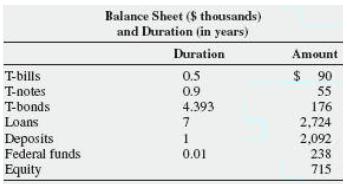

Question: Use the following balance sheet information to answer this question. a. What is the average duration of all the assets? b. What is the average

Use the following balance sheet information to answer this question.

a. What is the average duration of all the assets?

b. What is the average duration of all the liabilities?

c. What is the FI’s leverage- adjusted duration gap? What is the FI’s interest rate risk exposure?

d. If the entire yield curve shifted upward 0.5 percent (i. e., ∆R/(1 + R) = 0.0050), what is the impact on the FI’s market value of equity?

e. If the entire yield curve shifted downward 0.25 percent (i. e., ∆R/(1 + R ) = - 0.0025), what is the impact on the FI’s market value of equity?

Balance Sheet ($ thousands) and Duration (in years) Duration Amount T-bills $ 90 0.5 0.9 4.393 T-notes 55 T-bonds 176 2,724 2,092 Loans 7 Deposits Federal funds Equity 0.01 238 715

Step by Step Solution

3.55 Rating (162 Votes )

There are 3 Steps involved in it

a The weighted average duration of the assets is 05903045 09553045 43931763045 7272430... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

403-B-B-F-M (1967).docx

120 KBs Word File