Use the following information in answering questions 1 and 2: Par Company sells land with a book

Question:

Use the following information in answering questions 1 and 2: Par Company sells land with a book value of $5,000 to Sub Company for $6,000 in 2011. Sub Company holds the land during 2012. Sub Company sells the land for $8,000 to an outside entity in 2013.

1. In 2011 the unrealized gain:

a. To be eliminated is affected by the noncontrolling interest percentage

b. Is initially included in the subsidiary's accounts and must be eliminated from Par Company's income from Sub Company under the equity method

c. Is eliminated from consolidated net income by a workpaper entry that includes a credit to the land account for $1,000

d. Is eliminated from consolidated net income by a workpaper entry that includes a credit to the land account for $6,000

2. Which of the following statements is true?

a. Under the equity method, Par Company's Investment in Sub account will be $1,000 less than its underlying equity in Sub throughout 2012.

b. No workpaper adjustments for the land are required in 2012 if Par Company has applied the equity method correctly.

c. A workpaper entry debiting gain on sale of land and crediting land will be required each year until the land is sold outside the consolidated entity.

d. In 2013, the year of Sub's sale to an outside entity, the workpaper adjustment for the land will include a debit to gain on sale of land for $2,000. Use the following information in answering questions 3 and 4: Pen Corporation sold machinery to its 80 percent-owned subsidiary, Sam Corporation, for $100,000 on December 31, 2011. The cost of the machinery to Pen was $80,000, the book value at the time of sale was $60,000, and the machinery had a remaining useful life of five years.

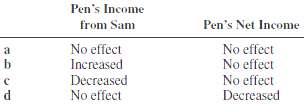

3. How will the intercompany sale affect Pen's income from Sam and Pen's net income for 2011?

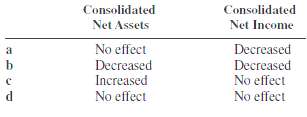

4. How will the consolidated assets and consolidated net income for 2011 be affected by the intercompanysale?

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Advanced Accounting

ISBN: 9780132568968

11th Edition

Authors: Floyd A. Beams, Joseph H. Anthony, Bruce Bettinghaus, Kenneth Smith